Markets Strong in Second Quarter 2019

By Jane Swan, Partner and Senior Advisor

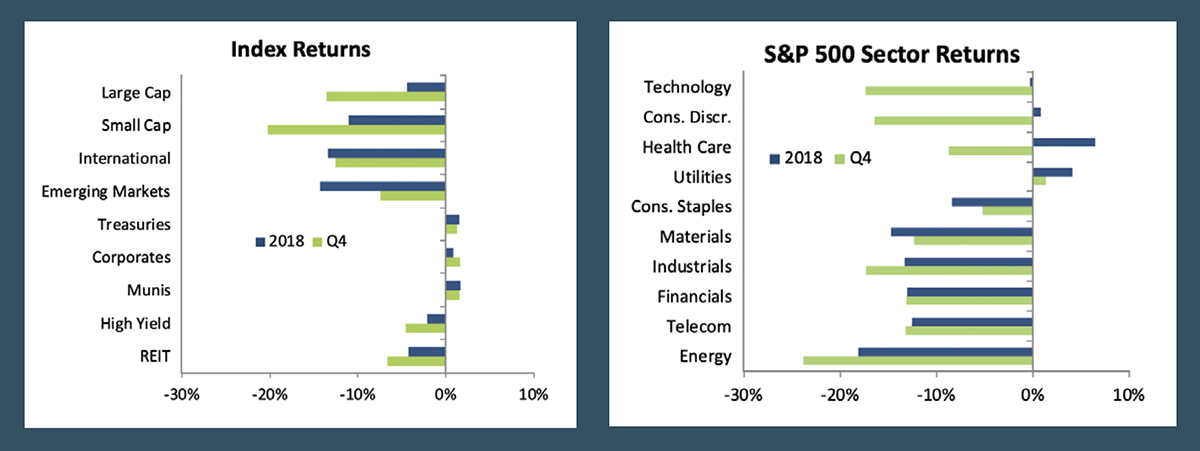

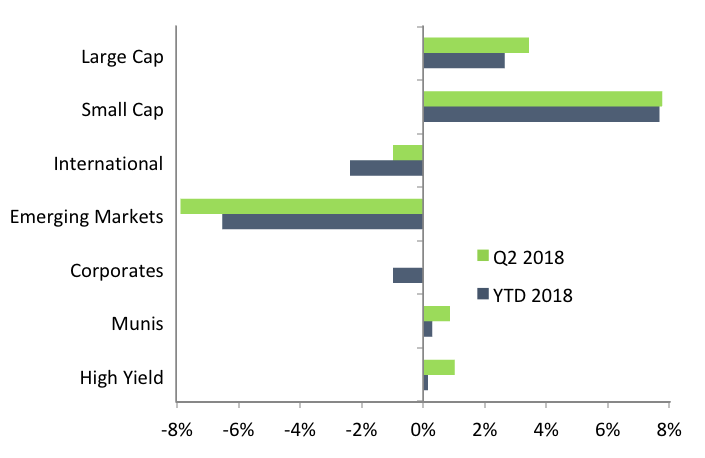

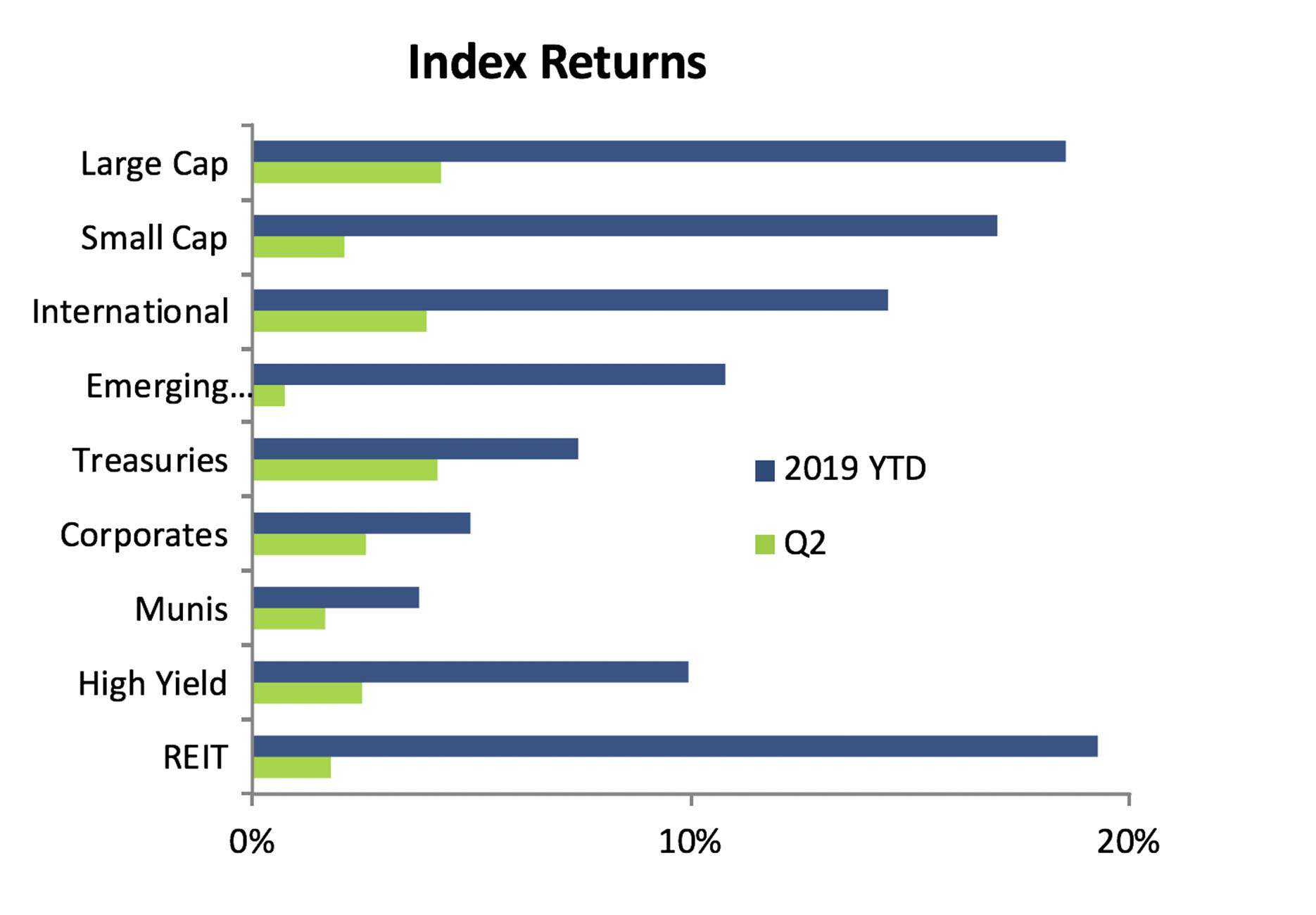

Positive returns across investment markets seem to have largely removed the decline and worry from the end of 2018 from our memories. U.S. equity markets added slightly to first quarter growth with large cap stocks up 4.3% in the quarter and 18.5% year-to-date (YTD). Small cap stocks are up 2.1% in the quarter and 17% YTD. International developed markets were up 4.2% in the quarter and 14.5% YTD. Emerging market stocks were up 0.7% for the quarter and 10.8% YTD. Fixed income markets were also positive on speculation of a reduction in Federal Funds rates playing a part in pushing returns higher. The 10-year treasury was up 4.2% for the quarter and 7.4% YTD. Corporates were up 2.6% in the quarter and 5% YTD, and municipal bonds were up 1.7% for the quarter and 3.8% YTD. High yield bonds were up 2.5% in the quarter and 9.9% YTD. They recovered considerably from the end of 2018, when there appeared to be more concern in low credit markets about future economic weakness. Real estate was also positive, with the REIT index up 1.8% in the quarter and 19.3% YTD.

1

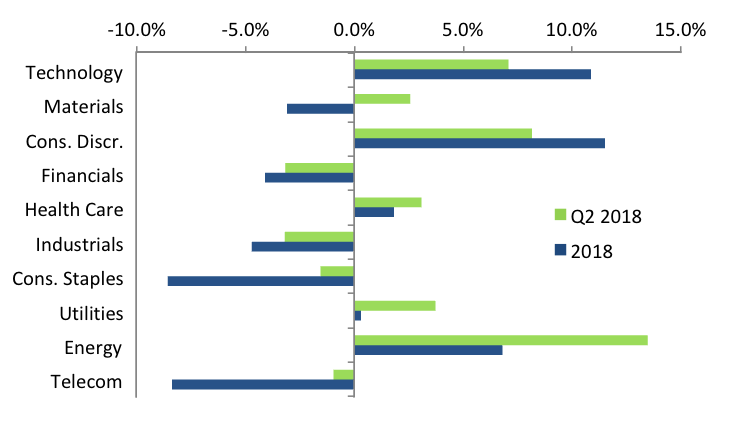

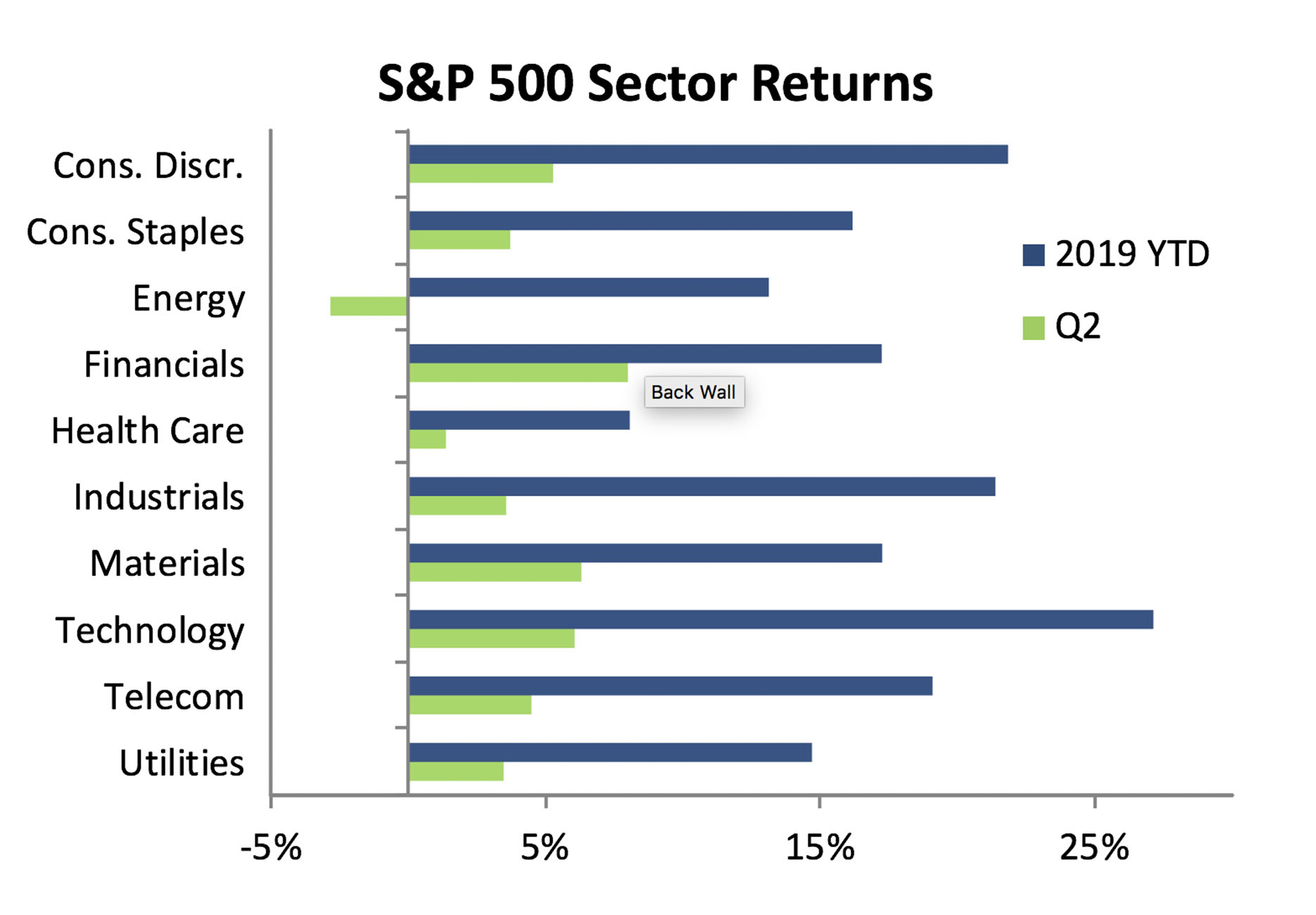

Within domestic equity markets, all sectors but the energy sector continued the positive returns of the first quarter. Even with the negative returns in the quarter for energy, all sectors are positive YTD. The solid rebound from the negative returns at the end of 2018 suggests investors may have a renewed confidence within financial markets. Some of this confidence can be tied to hints of possible accommodation by the Fed. We believe it is somewhat hard to understand this stance. Typically, a rate reduction is a tool reserved to stimulate a suffering or potentially suffering economy.

2

2

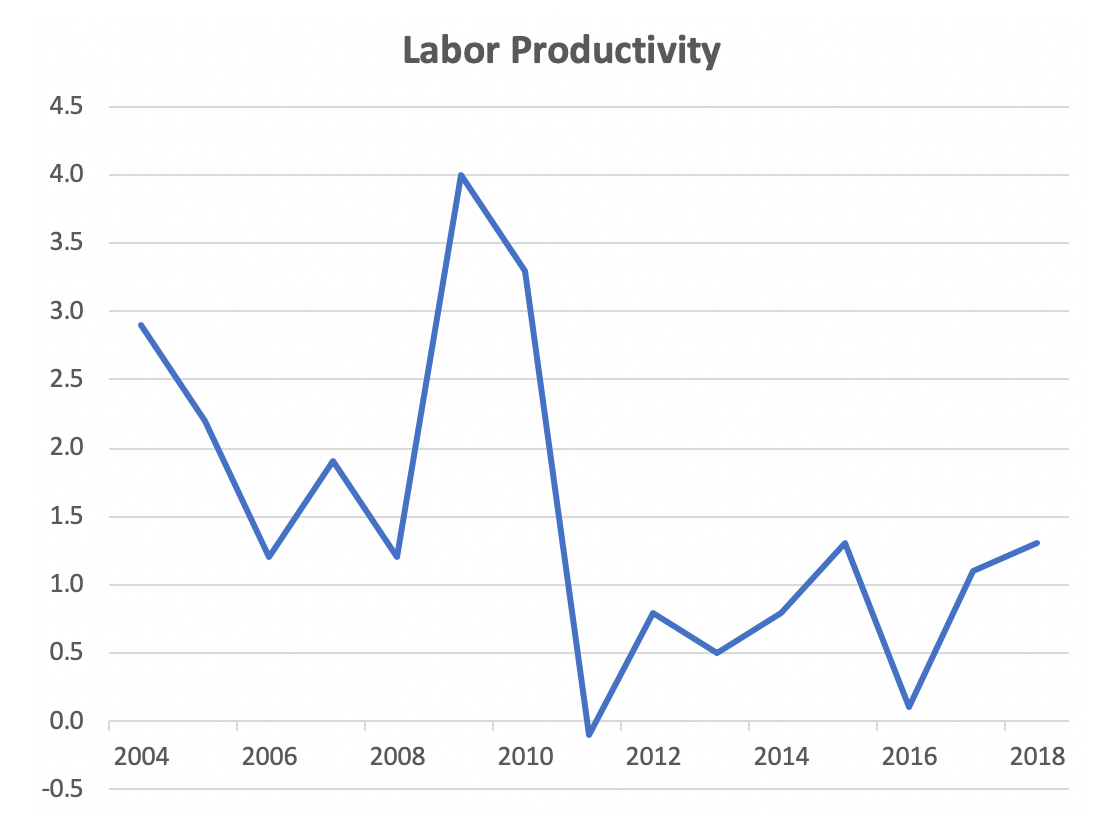

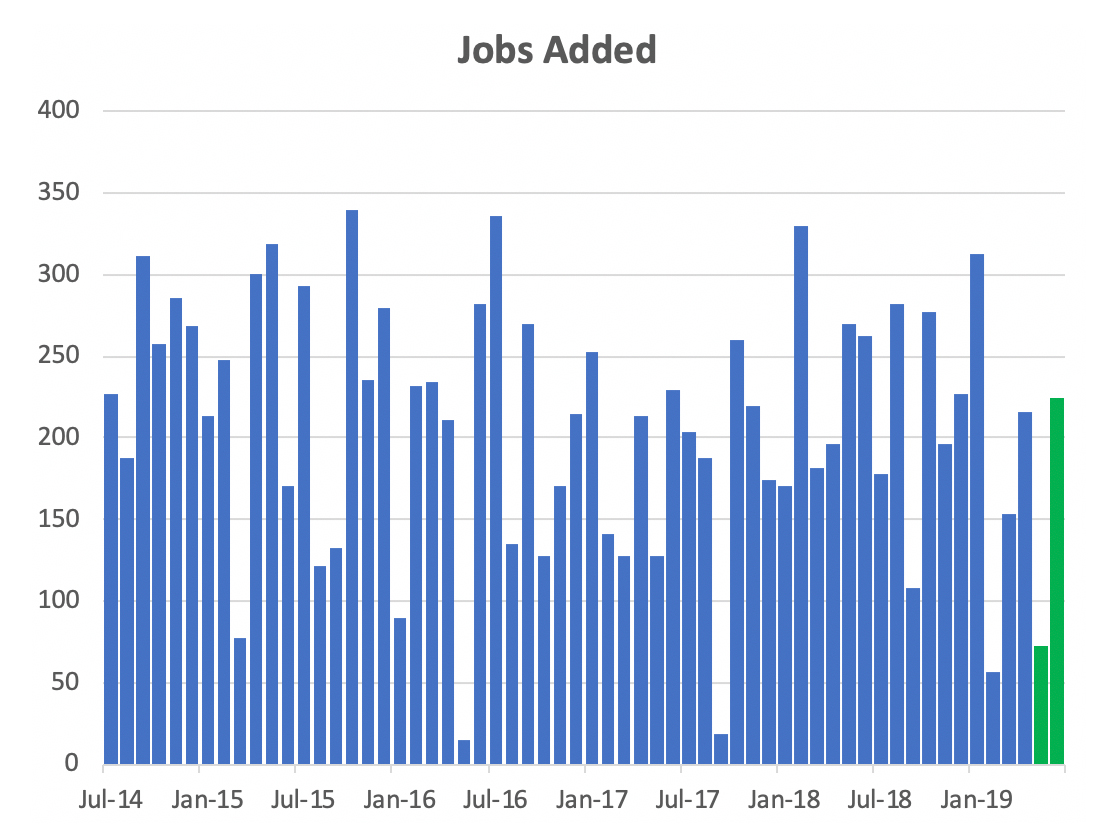

The argument for a potential rate cut is thought to be a softening job market. Growth in the economy can come from two key sources. If the number of workers grows while the productivity (value of goods produced) of each worker stays steady, the economy is likely to grow. If the number of workers stays steady but productivity per worker grows, the economy is likely to grow. During a recession, layoffs lead to a decrease in the number of workers, which eventually leads to an increase in the productivity of each worker and the economy again will grow. During an expansion, the number of workers often grows more robustly than the increases in productivity. Today’s potentially slowing rate in the number of workers with a modest level of productivity growth, is raising some concern that continued economic growth may become more fragile.

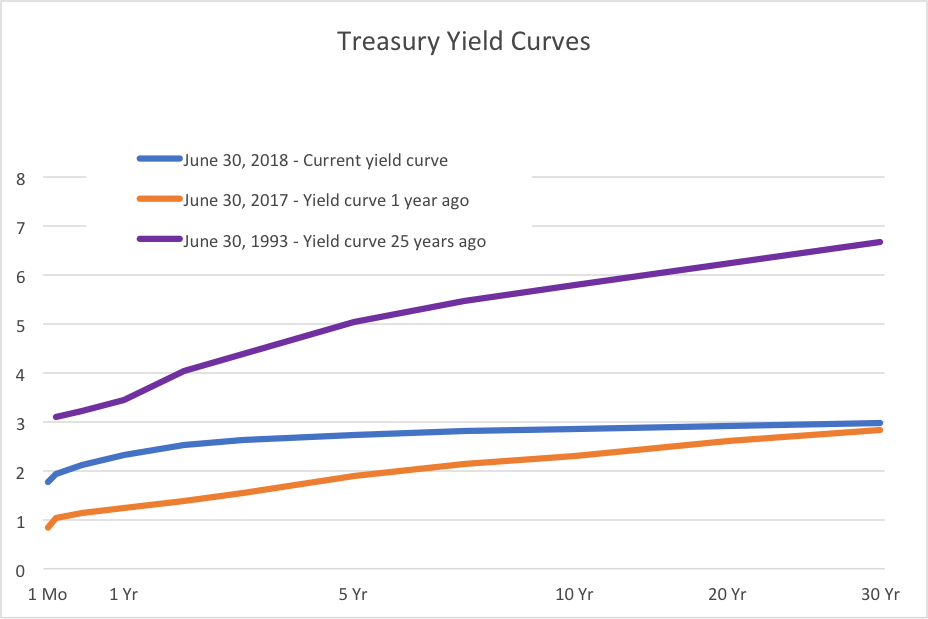

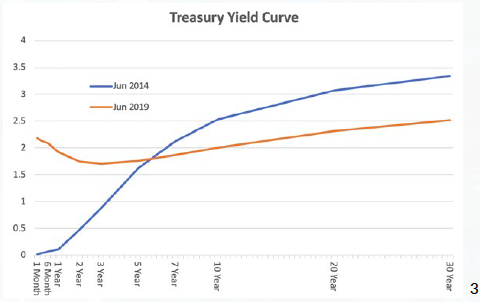

The forecasted cut in the Federal Funds rate aimed at prolonging economic growth is part of what has created the slight inversion to the yield curve. An inverted yield curve means that bonds with longer maturities pay a lower yield than bonds with shorter maturities. In the curve chart to the right, you see that five years ago, bonds of longer maturities paid a higher yield than bonds of shorter maturities. The current yield curve shows yields lower on some longer maturities than those of the shortest maturities. In an economy expected to grow, investors seek to be compensated more to have their funds tied up for a longer period of time. In the past six decades, the yield curve has inverted for three months, seven times. In each case, the economy entered a recession within two years. While this isn’t a statistically significant enough number of observations to draw a confident conclusion, it raises some concern that a prolonged inverted yield curve can be a sign of a soon to be slowing economy.

The forecasted cut in the Federal Funds rate aimed at prolonging economic growth is part of what has created the slight inversion to the yield curve. An inverted yield curve means that bonds with longer maturities pay a lower yield than bonds with shorter maturities. In the curve chart to the right, you see that five years ago, bonds of longer maturities paid a higher yield than bonds of shorter maturities. The current yield curve shows yields lower on some longer maturities than those of the shortest maturities. In an economy expected to grow, investors seek to be compensated more to have their funds tied up for a longer period of time. In the past six decades, the yield curve has inverted for three months, seven times. In each case, the economy entered a recession within two years. While this isn’t a statistically significant enough number of observations to draw a confident conclusion, it raises some concern that a prolonged inverted yield curve can be a sign of a soon to be slowing economy.

In this summer of global record heat, we believe there are obvious needs for growth in productivity and workers to combat climate change. New York City has joined eight U.S. states and over 100 cities and counties4 committed to transitioning over the next few decades to 100% renewable energy. This means that each community would produce more energy from renewable sources than it consumed. Getting there will require both workers and increases in productivity, which could play a role in economic growth. Without renewable energy targets from the national government, it continues to be up to cities, counties, states, and business to take the lead in creating this new economy.

As the stock market continues its longest expansion of our lifetimes, we invite our clients to connect with their wealth manager and evaluate their portfolios ability to meet their goals over a variety of market conditions.

1 PMC Envestnet Capital Market Report 7/3/2019

2 U.S. Bureau of Labor Statistics, Private Non-Farm Business Sector: Labor Productivity [MPU4910063], retrieved from FRED, Federal Reserve Bank of St. Louis

3 US Department of the Treasury

4 Sierra Club “100% Commitments in Cities, Counties, & States”