How Community Foundations Can Accelerate Social Change

By Patricia Farrar-Rivas, CEO

“The world has changed, and so must we.” – Clara Miller of The F.B. Heron Foundation

Clara’s right.

The time is now for community foundations to embrace a new vision that accelerates social progress and rebuilds local wealth.

The good news is that a new roadmap for community foundations is contained in a just-published report by The Democracy Collaborative, A New Anchor Mission for a New Century: Community Foundations Deploying All Resources to Build Community Wealth.

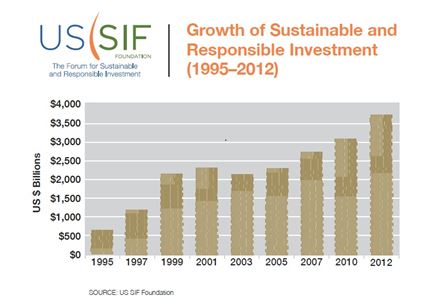

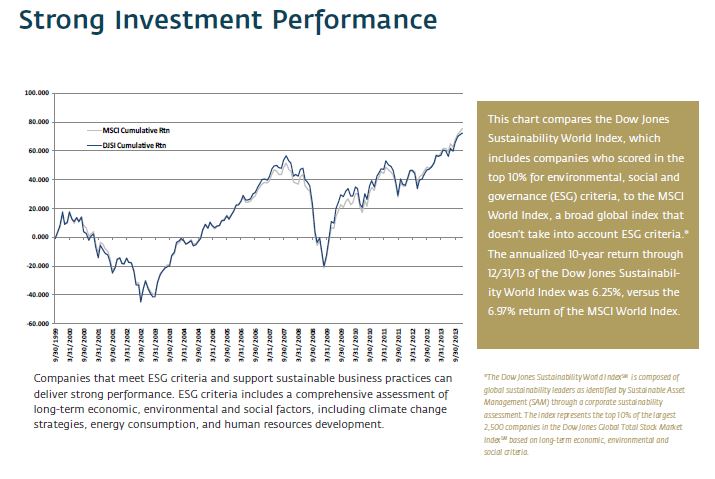

The report is recommended for anyone interested in making their community stronger, especially those encouraging social change through impact investing. Why? Impact investing is growing more rapidly among community foundations than other foundation sectors.

The 52-page report highlights how community foundations are innovating to build community wealth and profiles 30 innovative foundations across the country. The report describes how each of these forward-thinking organizations is rethinking its mission to have an even greater impact.

The Opportunity

Ted Howard, Executive Director of The Democracy Collaborative, explains that community foundations are evolving to play a lead role among major local “anchor institutions” including major universities, hospitals and non-profits. These institutions represent more than $1 trillion annually in economic activity and are grounded in their region.

The report showcases community foundations that are adopting this new anchor mission by deploying all of their resources—financial, human, social, intellectual—to create shared prosperity. This mission uses their twin financial resources, grants and investments, to help develop a locally rooted economy that is inclusive and sustainable.

“America’s more than 760 place-based community foundations can be a tremendous force for community economic revitalization,” Howard said. “Combined, their endowments total $65 billion and their annual grantmaking roughly $5 billion.

Community foundations are today at a tipping point, said Ronn Richard, president of the Cleveland Foundation. “Our field’s next century will be radically different from the first.”

In particular, community foundations are facing growing competition from a growing group of national donor advised funds, many of which are affiliated with commercial institutions such as Fidelity, Schwab, Vanguard, Citibank, and Goldman Sachs. Donor advised fund (DAF) assets at those institutions now surpass the DAF assets at community foundations, the report found.

Clara Miller of The F.B Heron Foundation noted that local foundations can provide new leadership in their communities. Most philanthropic approaches were designed for a world in which a small segment of the population lived in poverty. Today, Miller says poverty is structural and the urgency and size of the problems require that we work differently. “Everything at our disposal is now a mission-critical resource.”

Progress On Many Fronts

The report profiles a wide range of foundations, but three examples show how foundations are evolving to become anchor institutions.

- The Cleveland Foundation catalyzed the creation of three employee-owned Evergreen Cooperatives, including Evergreen Energy Solutions, a solar installation and energy solutions company launched in large part with the support of large contracts from local anchor institutions. The three cooperatives employ workers drawn from Cleveland’s inner city neighborhoods, where unemployment exceeds 25 percent and median household income is under $18,500 a year. Inspired by this model, a number of other community foundations have begun adapting this approach for their own communities.

- Vermont Community Foundation, based in Middlebury, VT, for the last decade has had a policy of devoting five percent of all assets—including donor advised funds—for investments that benefit Vermont. And through its Food and Farm Initiative, the foundation has deployed many other resources to build community wealth in the food and agriculture sector. The foundation supported legislation that created the Farm to Plate Initiative and funded the Initiative’s ten-year plan to increase economic development. It also helped launch the Vermont Farm to School Network, which seeks to create local food-buying programs at all Vermont schools by 2020.

- Incourage Community Foundation of Wisconsin Rapids, WI, this year made a new commitment to invest 100% percent of its resources for mission. Everything the foundation does—grants, investments, vendor relations, and hiring—will be re-examined with a focus on creating a community that works for all. Incourage made a commitment to invest all its financial assets for mission, making it the first community foundation to take such a pledge.

The Democracy Collaborative is doing great work helping foundations shift their mindset from poverty reduction to wealth creation. This is the kind of inspired thinking that benefits all of us.

Patricia Farrar-Rivas is CEO of Veris Wealth Partners.