Impact Investing: A Smarter Way to Invest

By Patricia Farrar-Rivas, CEO

When we founded Veris six years ago, we were among the very few who believed in the power of impact investing to create wealth and improve the world.

Today, with the planet’s long term viability at risk, we can no longer ignore the connection between global issues and individual choices. In their scale and complexity, today’s problems are unlike any we have ever encountered.

And yet, big challenges create big opportunities.

We are convinced that 21st century investing must see sustainability as a primary driver of growth and innovation.

Deeper and Better Answers

At Veris, our mission is to manage wealth in a sustainable manner, and in so doing, participate in fundamentally transforming our capital markets.

The differentiator for impact investing is how it integrates business, social, environmental and economic factors into investment analyses. The differentiator for impact investors is their commitment to using capital markets to drive the positive change that governments and philanthropy cannot realize alone.

With more variables in play and redefined measures of “return” and “value,” impact investors are looking for deeper and better answers.

In asking questions about environmental impact, they are quantifying risks that were previously ignored. In assessing gender inclusion, they are challenging how financial markets value women and girls. And in committing to positive impact, these investors see “stakeholders” — workers, consumers, communities, the environment and shareholders — as the ultimate beneficiaries of invested capital.

We always knew that impact investing would one day catch fire. That day is here.

Consider the following:

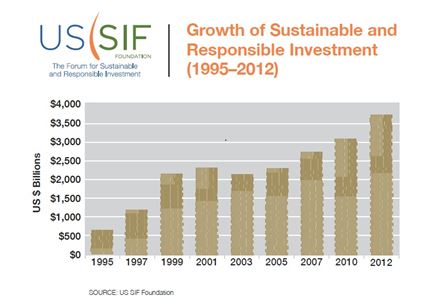

- One out of every nine dollars under professional management in the U.S. is now invested in impact/socially responsible investing strategies. SRI assets have grown from $639 billion in 1995 to $3.74 trillion in 2012.

- Today’s impact investors have opportunities for change not possible 10 years ago. Do you want to help save a key watershed? Improve organic farmland? Help business creation in the poorest developing countries? Or build a really functional toilet, yes toilet, for people who have none? Impact investing goes deep for change.

- Impact investing has gone mainstream. This past fall, the largest brokerages in the country, Merrill Lynch and Morgan Stanley, made high profile commitments to impact investing. Others who have traditionally ignored the field are now doing the same. Establishment institutions can no longer afford to stand idle during one of the most profound shifts in investor sentiment in our lifetime.

- The industry infrastructure is expanding to support impact investing. Wealth advisors now have no reason not to put their clients’ money in impact investments. Envestnet’s Sustainability Platform makes it easy for wealth advisors to invest with impact across all asset classes. In fact, impact assets have risen 260% to $625 million over the past two years. Veris is proud to power Envestnet’s impact investing platform.

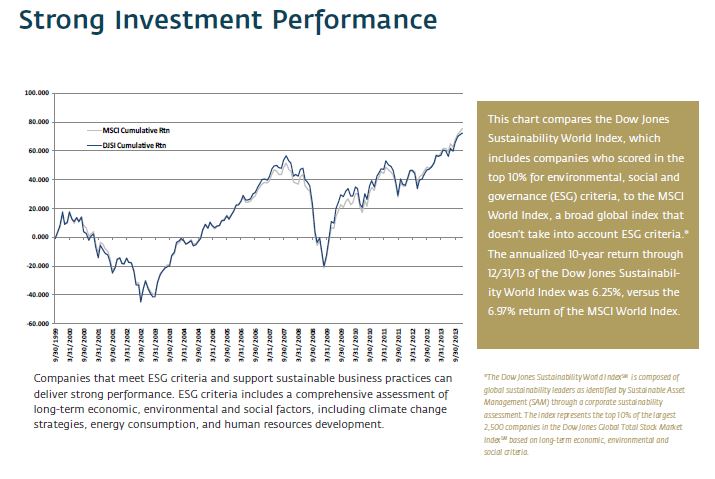

Competitive Performance

The good news: it’s abundantly clear that investors don’t have to sacrifice performance to achieve positive social impact. Numerous, credible academic and industry studies demonstrate that investing in companies that follow Environmental, Social and Governance (ESG) criteria can deliver investment performance competitive with traditional approaches.

The possibility of achieving both financial and social/environmental returns is why we say impact investing is a smarter way to invest.

Broadening the Debate

The success of impact investing is enlightening the debate about many social issues. Two timely ones are Climate Change and Gender Lens Investing. In 2013, the dialogue around these issues exploded. We’re excited to be part of the global conversation reshaping how investors think about the social implications of capital allocation.

As we begin 2014, we see tremendous opportunity ahead.

Impact investing is a powerful tool for delivering maximum benefit for everyone on the planet. Working together, we can find innovative solutions that address intractable problems.

We invite you to join us.