How Do Domestic Public Equity Impact Investments Perform?

By Michael Lent, Chief Investment Officer

One of the questions we hear often is whether there is a financial performance trade-off to impact investing. So, how does the domestic public equity segment of impact investing stack up?

The short answer: Very well compared to relevant traditional benchmarks.

At Veris Wealth Partners, we practice impact investing each and every day. We manage our clients’ portfolios to generate financial returns with positive social and/or environmental results. We believe you can achieve impact across all asset classes, including domestic public equity. Domestic public equity is a tremendous opportunity to invest in forward-thinking corporations leading in governance practices. They are also leaders in board diversity, and operational excellence in utilizing renewable energy and greener supply chains. These corporate innovators are creating scalable solutions to global challenges. They are positively impacting the lives of key stakeholders – employees, customers, communities, and the environment we all share.

A Good Yardstick

One of the best sustainable proxies for a domestic public equity allocation is the MSCI KLD 400 Social Index. It takes a broad market index, the MSCI USA, and selects only those companies that meet best-in-class environmental, social and governance (ESG) criteria.

In 2013, the annual performance of the MSCI KLD 400 Social Index was +36.2%. That was better than traditional (non-impact) indices, such as the MSCI USA Index, which returned +32.6% and the S&P 500 Index returning +32.3% over the same period. Companies with higher positive environmental and social impacts outperformed both traditional indices by more than 350 basis points.

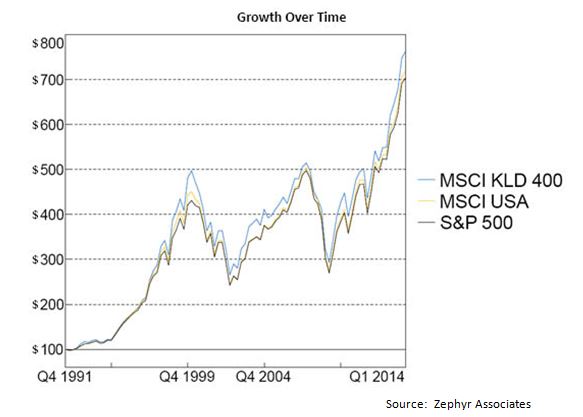

2013 was clearly a good year, but in some years, the MSCI KLD 400 underperformed the MSCI USA and the S&P 500. At Veris, we prefer to look at performance over the longer term. Since January 1992 the MSCI KLD 400 has produced an annualized return of +9.58%, compared to the MSCI USA Index which returned +9.29%. Over this same period, the S&P 500 Index returned +9.19%. Results show higher positive-impact domestic companies outperform their traditional competitors over the long-term — this is evident in the chart below which exhibits the growth of $100 over time. MSCI KLD 400 is the blue line outpacing the others.

Impact Performance

In addition to financial performance, Veris looks for investments that create measurable positive social and/or environmental impact such as lower reliance on carbon intensive energy, product innovation, employee empowerment, efficient water usage and more. Investors have growing access to sophisticated Environmental, Social and Governance (ESG) data for public corporations through organizations like Sustainalytics and MSCI. As the quality of ESG data improves, asset managers get better at incorporating ESG data at a company level.

By integrating impact into performance, we measure total integrated return of client’s investments to include financial externalities. We believe that integrating financial and non-financial returns may allow our portfolios to outperform traditional portfolios given their ability to respond to increasing natural resource constraints, innovation, and ability to target growing demand by customers for products and services that solve problems instead of creating more.

Shareholder Engagement

Public equity impact investing also provides the ability for shareholders to engage corporate management and boards in dialogue around key issues for ESG improvement. Increasingly shareholders are winning interventions on issues from climate change to human slavery. Rather than a “nice to have,” impact investors demand using their company ownership to direct votes for corporate change.

What Veris Looks For

Veris utilizes a proprietary due diligence process to evaluate investments from both a risk-adjusted and impact performance perspective that compares investments to impact and traditional indices. For public equity, we look for managers that integrate ESG criteria into their investment management process.

Opportunity Abounds

In the past there were many fewer ways to achieve positive financial and impact return. As impact investing moves from niche to mainstream, we see a significant increase in available investments. Opportunities exist across all asset classes, empowering visitors to build diversified portfolios to achieve their total performance objectives. The growing number of quality management teams producing admirable performance directly results from increased demand from individuals and foundations putting their wealth to work with purpose.

Veris is pleased to work with clients committed to maximizing their total impact investment performance – financial, environmental and social.