Veris Economic and Market Update: Q1 2024

By Jane Swan, CFA and Roraj Pradhananga, CIMA & CPA

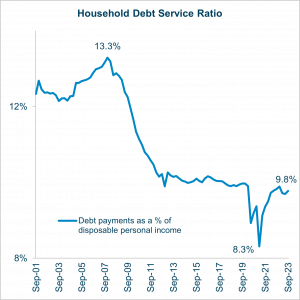

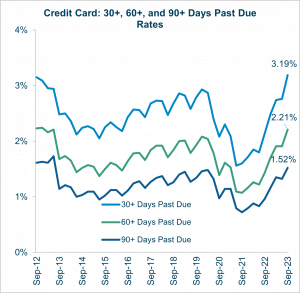

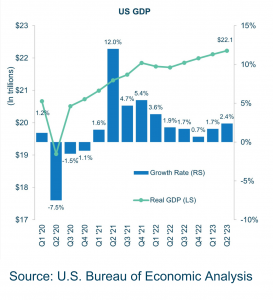

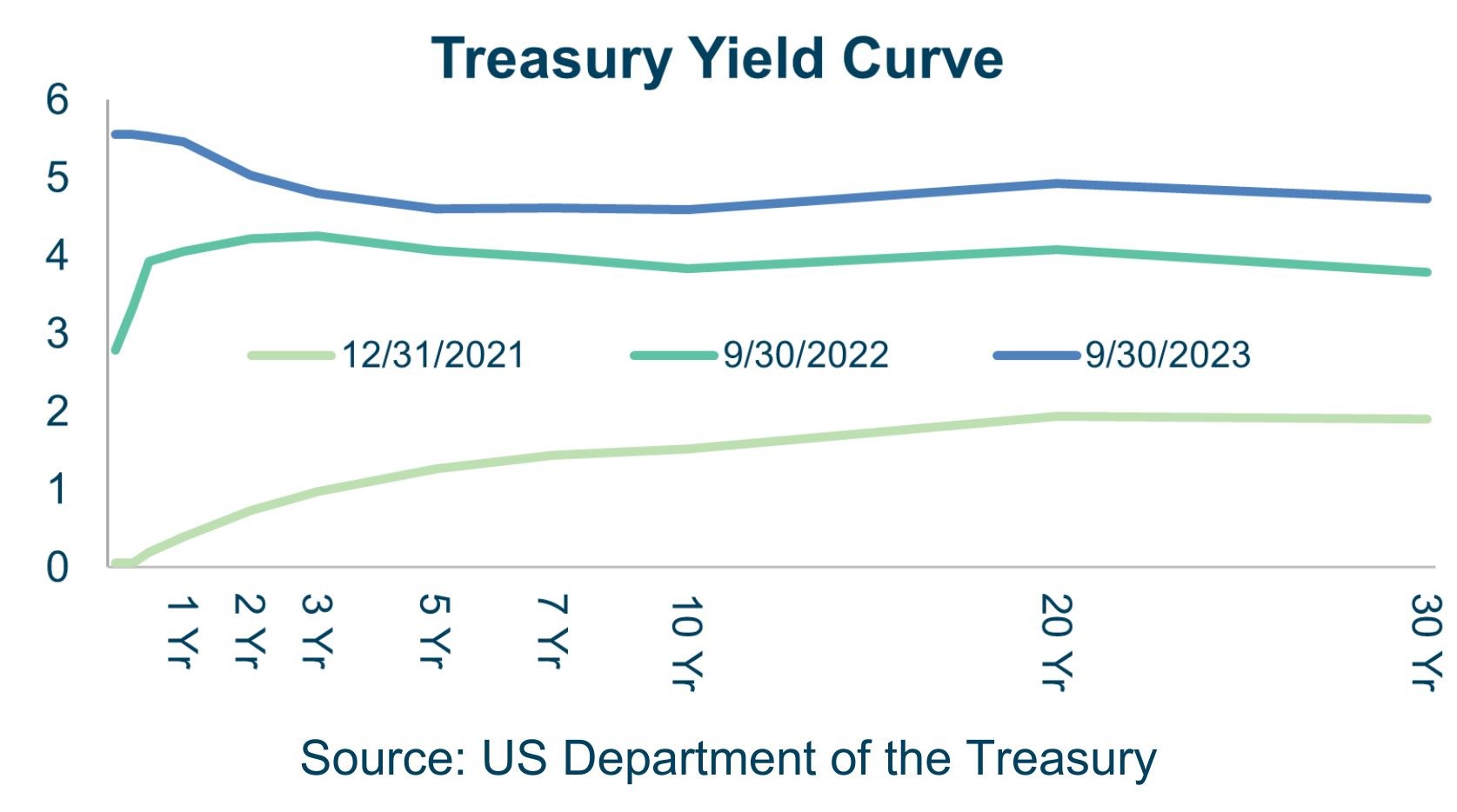

Against the headwinds of eleven Fed interest rate hikes, which started in March of 2022 and plateaued at 5.25%-5.5% in July of 2023, the US economy remains strong. 1 Consumer spending withstood higher borrowing costs, persistent, but slowing, inflation, and the dwindling of pandemic era savings.

Both the manufacturing and services purchasing manager index (PMI), which are indicators of economic resilience, were in expansionary territory as of March 2024. There was a slight deterioration in services PMI in the first quarter and consumer sentiment worsened due to higher inflation expectations, but real wage growth remains positive supporting consumer spending, which accounts for nearly 70% of the US GDP.

Sources: US Bureau of Economic Analysis, FRED, and Bureau of Labor Statistics2

Note: RS and LS refer to the right and left series in the chart

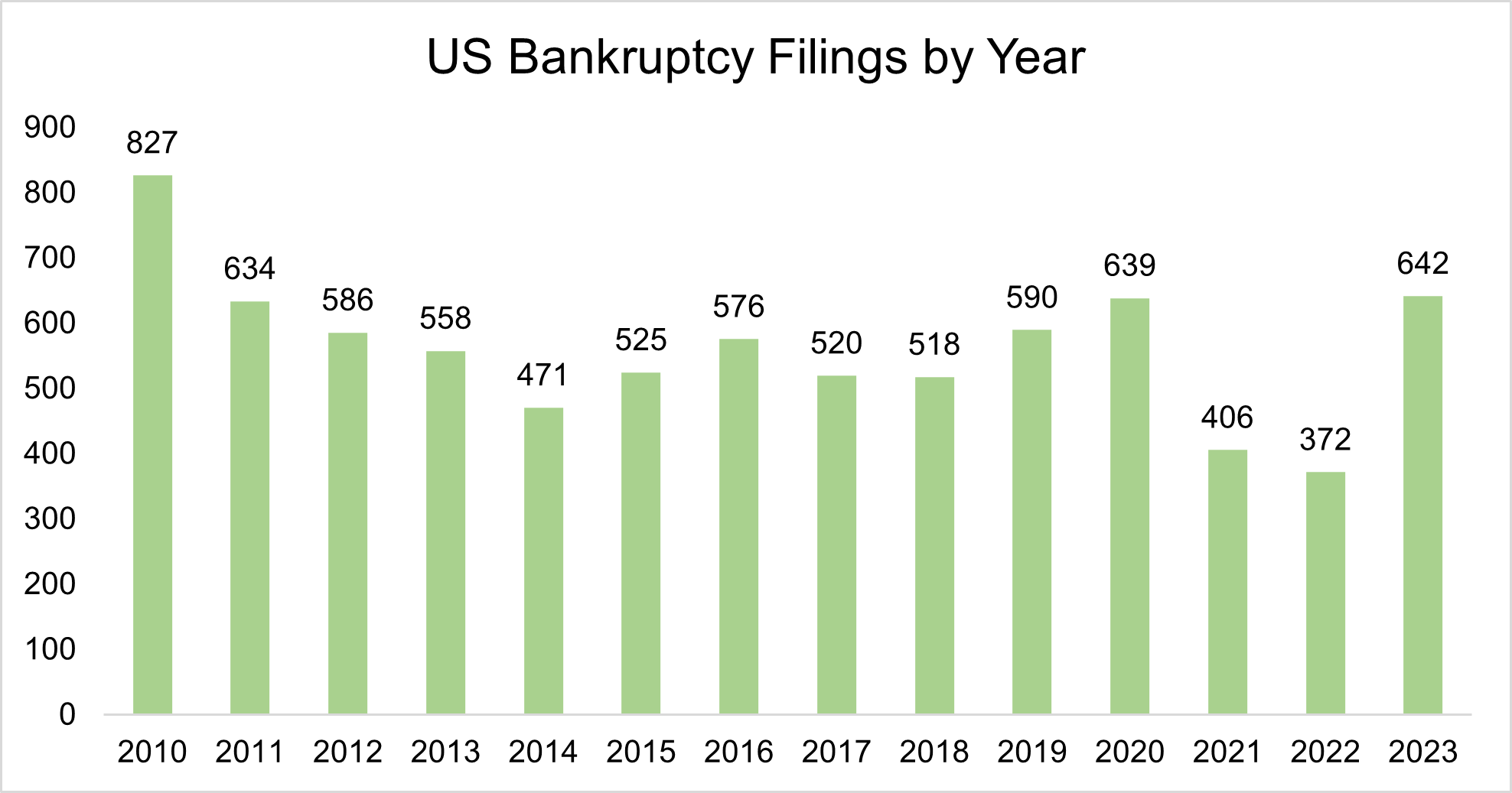

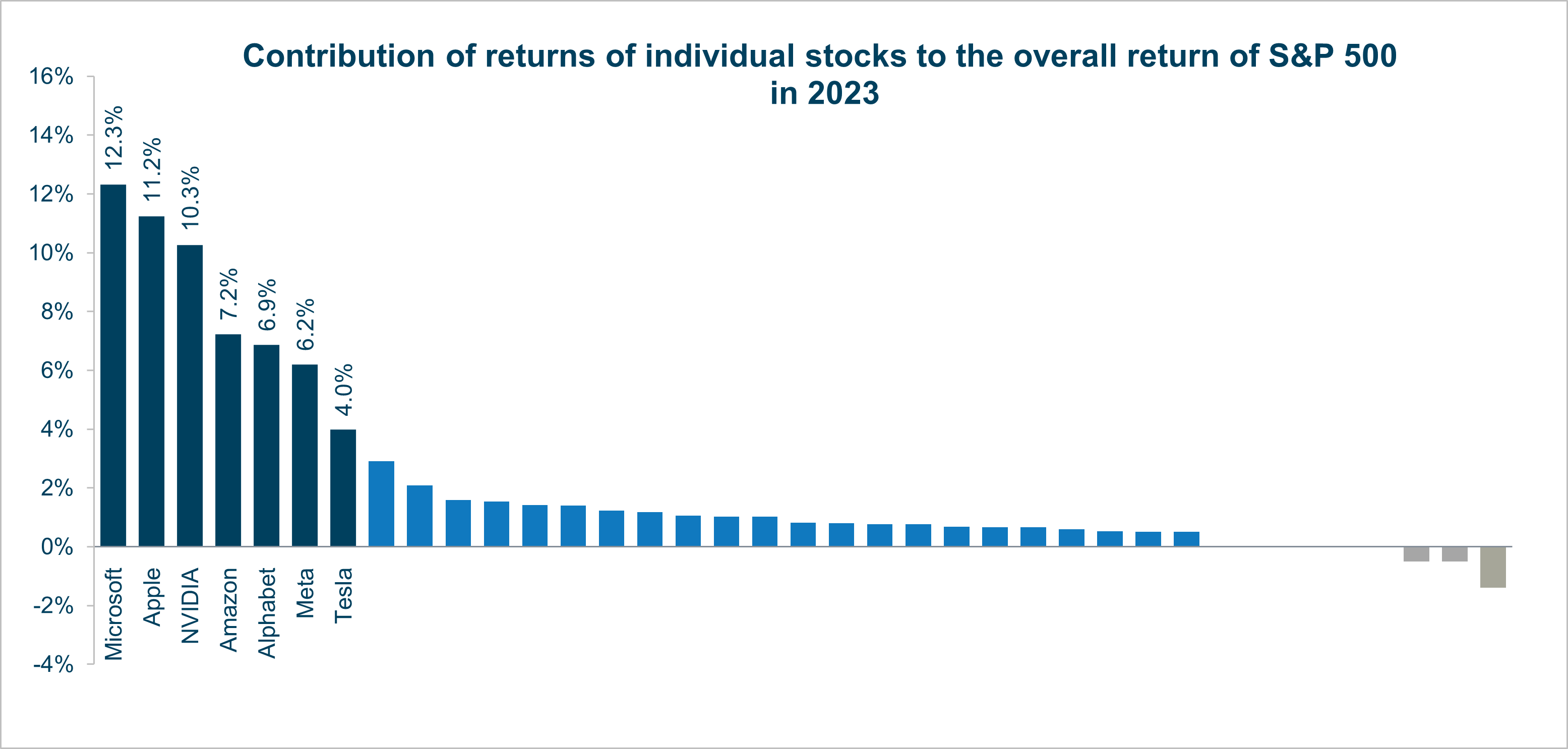

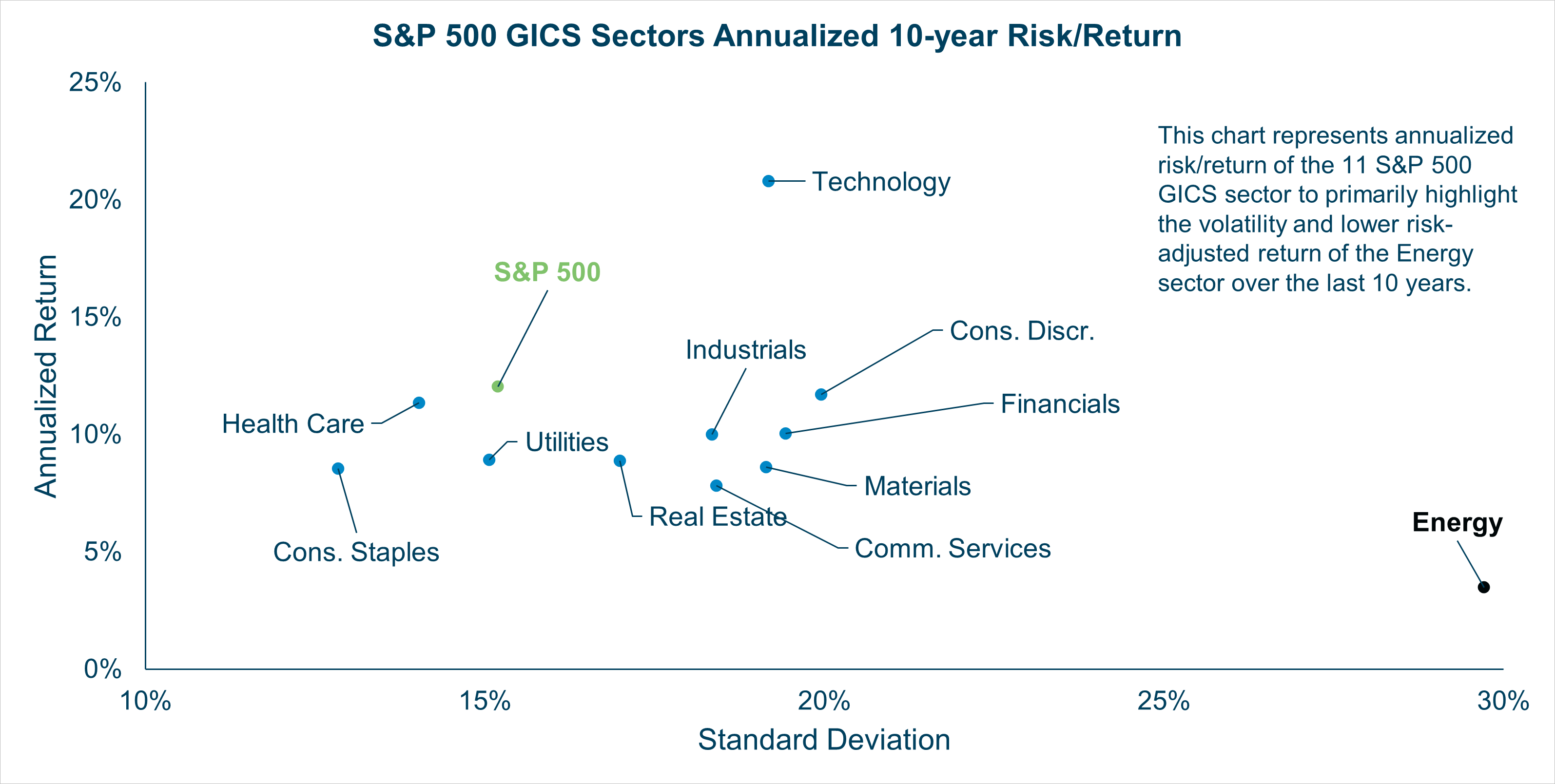

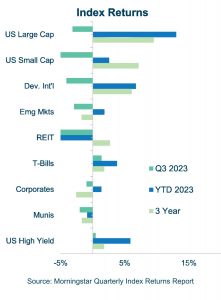

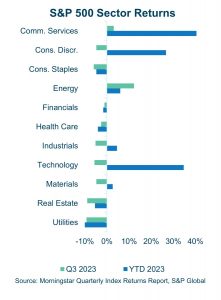

Public equity markets had positive returns in Q1 as earnings and economic data remained strong and soft-landing optimism persisted. Valuation concerns were brushed aside by strong revenue growth and earnings and the stock market rally broadened beyond the winners of 2023. Technology companies continued to benefit from the artificial intelligence exuberance. US markets outperformed developed international and emerging markets on the back of a strong dollar. While higher than expected inflation, rising yields or the probability of rates staying higher for longer didn’t affect the stock market performance, bond markets were negatively impacted.

Source: Morningstar 3

The seven US large-cap companies – Microsoft, Apple, Nvidia, Meta, Amazon, Tesla, and Alphabet – which were responsible for more than half of the gains in 2023 have been dispersed in 2024. Nvidia and Meta lead gains while Tesla and Apple lagged the S&P 500. The “Magnificent Seven” represented approximately 29% of the S&P 500 Index weight and accounted for 37% of the S&P 500 Index returns for Q1 compared to 58% in 2023. This poses significant concentration risk. Meta, which owns brands including Facebook, Instagram, and WhatsApp, was up 37% in Q1 and 129% over the last 12 months. Nvidia rose 82% in Q1 and a staggering 225% over the last 12 months.

Source: Morningstar, Morningstar Quarterly Index Returns Report, FRED, and US Department of the Treasury 4

The stock market rally broadened beyond the Technology, Consumer Discretionary, and Communication Services sectors, which benefited from the rise of the Magnificent Seven in 2023. Revenue and earnings growth remain robust, and all sectors of the S&P 500 except Real Estate posted positive returns in Q1. The concentration of the top 10 stocks in the S&P 500 and Magnificent Seven stocks within their respective three sectors remain at historic highs. The concentration risk was evident through Tesla’s drag on the Consumer Discretionary sector despite robust consumer spending.

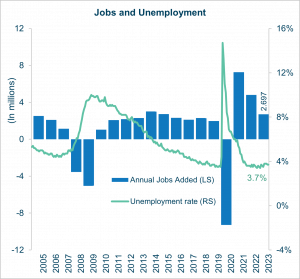

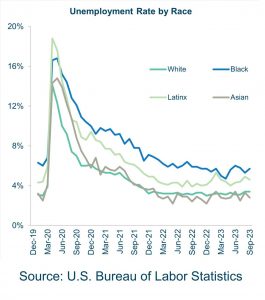

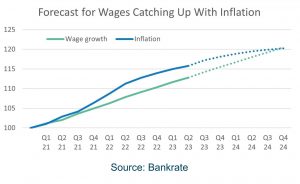

The US labor market remains strong with an unemployment rate below 4% for two full years, average hourly earnings up 4.1% year-over-year, and labor rate participation increasing to 62.7%. This brings the labor participation rate closer to pre-pandemic levels after dropping to 60.1% in 2020. 5 Employers have added over 800K jobs in the first three months of the year, which is almost a third of total jobs added last year. Job growth is expanding across industries with leisure and hospitality now back above its pre-pandemic level. However, there are pockets of weakness such as the quits rate which has flattened at 2.2% and the unemployment rate for Black Americans has increased to 6.4% in March, the highest since August 2022.

Source: US Bureau of Economic Analysis, FRED, & Bureau of Labor Statistics 6

Source: Federal Reserve Bank of St. Louis 7

Through low unemployment and increasing labor participation, wage growth for low-income workers in America has had its steepest increases in 40 years. 8 Increases to minimum wages in 28 states since 2020 have contributed to this spike in income for these workers. 9 Congress has failed to increase the federal minimum wage for 14 years, leaving it at $7.25 for workers in states and municipalities that haven’t taken action.

Along with those policy gains raising many minimum wages, 2023 saw a resurgence of strength from organized labor. Labor wins included established unions such as United Auto Workers and those representing Screen Actors and Writers, as well as new independent unions representing workers at some Amazon plants and Starbucks stores.

Source: Economic Policy Institute 10

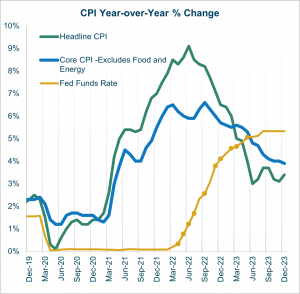

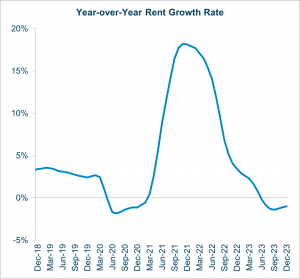

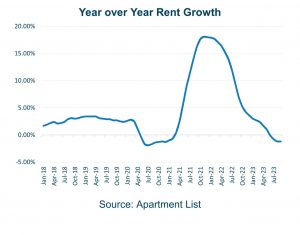

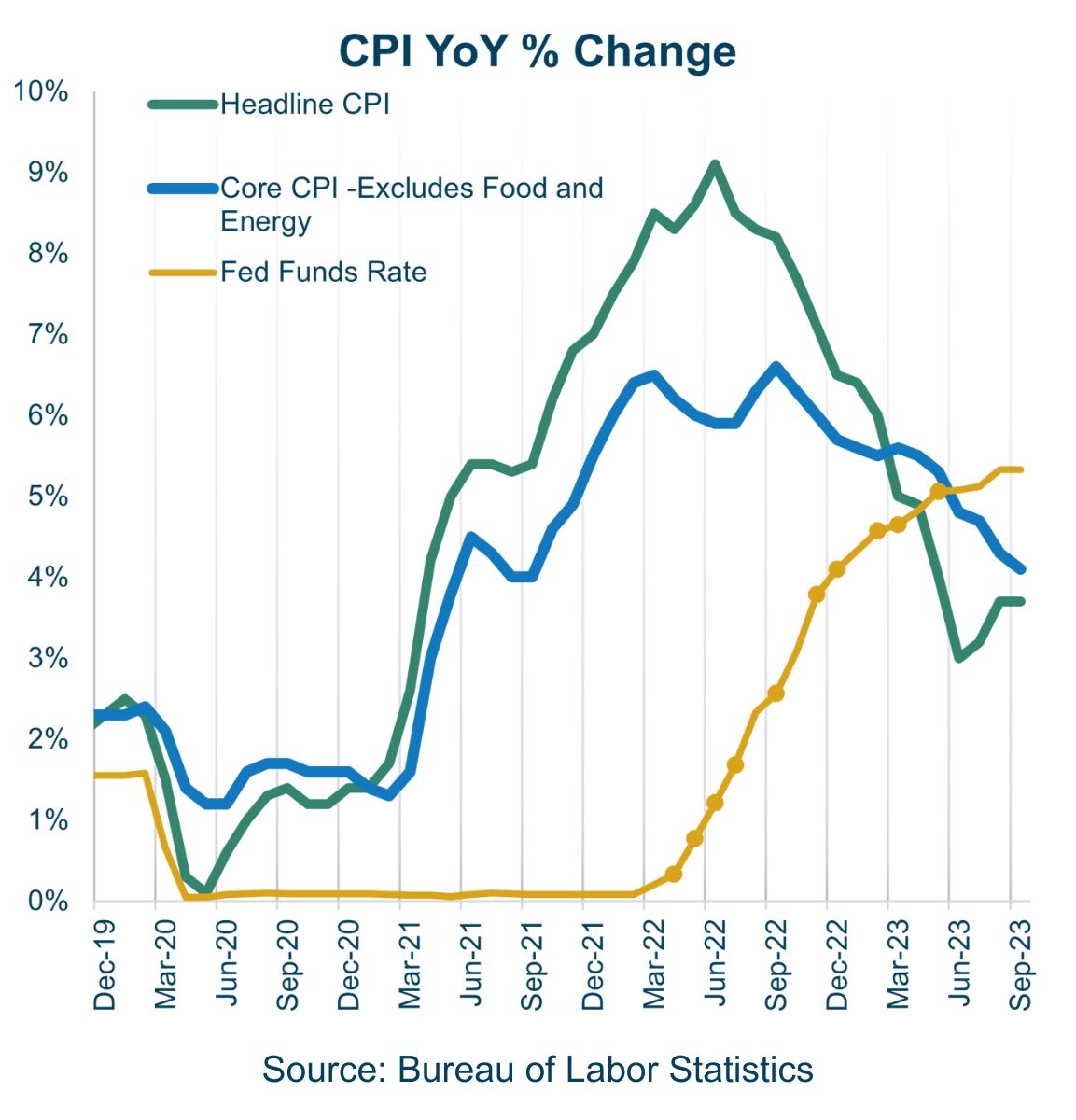

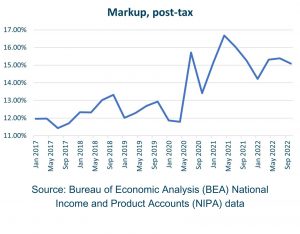

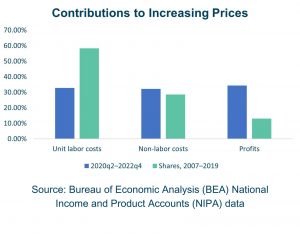

Headline inflation rose to 3.5% in March, up 0.1% from December 2023. While this is a meaningful drop from the peak of 9.1% in June 2022, recent data has indicated that inflation could remain sticky and be slow to drop to the Fed’s long-term target of 2%. Core CPI, excluding food and energy, is downward trending but remains high driven by elevated shelter (housing) inflation and transportation services. The Producer Price Index (PPI), an indicator of future inflation, rose in March but transportation services which drove March CPI came in softer than expected suggesting a continued downward trend. The Fed left interest rates unchanged in March and the markets now expect one rate cut instead of three in 2024.

For context, the most recent prior period of high inflation, The Great Inflation, spanned from 1965 to 1982, reaching over 18% at its peak in 1980.11 About 25% of the US adult population has prior experience weathering high inflation (including all Americans old enough to have been adults during the inflation crisis ending in 1982).12 For the other ~75% of the adult population, experience with price volatility has been most apparent in fluctuating gas prices, until the last couple of years. The Fed focuses on core measures of inflation, stripping out food and energy to remove the most volatile elements, smoothing out inflation in an attempt to better measure the impact of monetary policy.13

Source: Federal Reserve Economic Data (FRED) 14

The approach of the Fed, stripping out food and energy, differs from many consumers, some of whom focus and experience inflation most on food and energy. While energy prices have increased significantly over the last four decades, they have gone up for periods and then eventually retreated at least partially back towards prior prices. This is very different from the broad CPI measure of inflation which primarily goes up at high or low rates, but very rarely is negative. Of all the monthly data going back to 1965, less than 2% of monthly measures of year-over-year changes to CPI have been negative. Prices go up consistently, but unlike what we have experienced with gasoline, they rarely go down. This may have contributed to the confusion amongst consumers who have not yet experienced prolonged inflation as to why prices don’t return to prior levels when inflation growth rates drop.15 Economists warn that price decreases, deflation, is potentially harmful to the economy.16 If consumers expect prices to drop, they delay purchases in anticipation of lower prices. This can contribute to a slowing or spiraling economy, rather than the desired soft landing. The length and severity of The Great Inflation likely contribute to the cautious approach of the Fed, declining to lower interest rates while reductions to inflation remain unstable.

Source: Federal Reserve Economic Data (FRED) 17

Source: Federal Reserve Economic Data (FRED) 18

We expect lingering inflation and election volatility to weigh heavily on markets. Uncertainty in any form destabilizes markets. Companies, not knowing future interest rates or wildcard policies out of Washington DC, may limit planning and investment. Through the pandemic, people and businesses relied on innovation to navigate uncertainty. Innovation helped us shift to hybrid work schedules and has launched conversations reimagining cities, office space, and housing. Advancement in Artificial Intelligence stands to alter our future in ways we are just beginning to quantify. Amidst this uncertainty and with market gains over the last 12 months, we invite clients to work with your Veris team to prepare for the months and years ahead.

Jane Swan is a Partner, Senior Advisor, and Head of Advisory Services at Veris and holds the Chartered Financial Analyst (CFA®) designation.

Roraj Pradhananga is a Partner, Co-CIO, and Managing Director of Investments at Veris. He holds the Certified Investment Management Analyst (CIMA®) and Certified Public Accountant (CPA) designations.

References

1 https://www.federalreserve.gov/monetarypolicy/openmarket.htm

2 US Bureau of Economic Analysis, FRED, and Bureau of Labor Statistics

3 Morningstar

4 Morningstar, Morningstar Quarterly Index Returns Report, FRED, and US Department of the Treasury

5 U.S. Bureau of Labor Statistics, Labor Force Participation Rate [CIVPART], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CIVPART, April 22, 2024.

6 U.S. Bureau of Economic Analysis, FRED, and U.S. Bureau of Labor Statistics

7 Federal Reserve Bank of St. Louis Economic Research Division

8 https://www.epi.org/publication/swa-wages-2023/

9 https://www.epi.org/minimum-wage-tracker/

10 https://www.epi.org/publication/swa-wages-2023/#epi-toc-12

11 https://www.federalreservehistory.org/essays/great-inflation

12 https://www.census.gov/library/stories/2023/05/2020-census-united-states-older-population-grew.html and https://www.federalreservehistory.org/essays/great-inflation#:~:text=1965%E2%80%931982,Fed%20and%20other%20central%20banks

14 Federal Reserve Economic Data (FRED)

15 https://www.nytimes.com/2024/02/20/business/economy/food-price-inflation-cools.html

16 https://fortune.com/2024/03/30/inflation-why-deflation-is-bad-what-difference-with-disinflation/

17 Source: Federal Reserve Economic Data (FRED)

18 Source: Federal Reserve Economic Data (FRED)

Disclaimer

The information contained herein is provided for informational purposes only and should not be construed as the provision of personalized investment advice, or an offer to sell or the solicitation of any offer to buy any securities. Rather, the contents including, without limitation, any forecasts and projections, simply reflect the opinions and views of the authors.

All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change without notice. There is no guarantee that the views and opinions expressed herein will come to pass. Additionally, this document contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information derived from such third party sources and take no responsibility therefore. Information related to the performance of certain benchmark indices is provided for illustrative purposes only as investors cannot invest directly in an index. Past performance is not indicative of or a guarantee of future results. Investing involves risk, including the potential loss of all amounts invested.