Veris Economic and Market Update: Q4 2023

The US economy remains resilient, supported by strong retail spending and labor markets and signs of improving consumer confidence¹ and strengthening in housing markets.

In the third quarter of 2023, GDP grew at its fastest rate in nearly two years – driven by consumer and government spending and private inventory investment.² However, we believe recent indications signal that economic growth is slowing down. The US Manufacturing Purchasing Managers’ Index (PMI) was in negative territory as of Q4 2023.³ ⁴ Consumer debt is also increasing,⁵ indicating that retail spending may be driven by borrowing as pandemic era savings dwindle. The 4th quarter GDP estimate, currently at 2.4%,⁶ suggests the economy has remained strong.

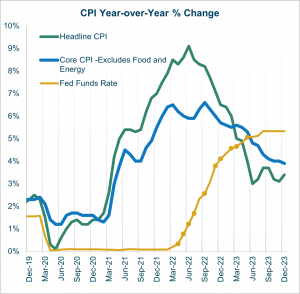

Inflation Dropped in the US in 2023

Source: Bureau of Labor Statistics

Meanwhile, inflation cooled substantially in 2023. Headline inflation dropped meaningfully to 3.4% in December 2023 from the peak of 9.1% in June 2022 due to the Fed’s decision to keep interest rates higher for longer to further tame inflation and the post-pandemic supply chain continued to recover.⁷

The disinflation (reduction in the rate of inflation) in 2023 reinforced market expectations of a soft landing. The inflation rate declining so steeply without igniting a recession, thus far, appears to have been achieved. Slowing inflation is not distributed equally across all sectors of the economy. We believe that various components, including shelter, food, and energy, will likely continue to drive monthly fluctuation in headline inflation.

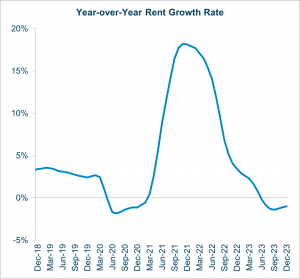

Source: ApartmentList.com

The Fed is data-dependent rather than headline dependent and focuses on core CPI which eased in the quarter but remains above the Fed’s 2% target. Shelter remains the main driver of increases in core CPI at 6.2% year-over-year as most rental contracts are at least one-year long, but leading indicators predict lower shelter prices.⁸

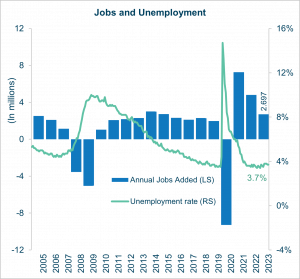

US Labor Market Strength

The US labor market remains strong despite slight increases from its 50-year low in early 2023. Non-farm payroll employment and weekly jobless claims continue to surprise to the upside despite announcements of layoffs by many companies.

Sources: U.S. Bureau of Economic Analysis, FRED, and U.S. Bureau of Labor Statistics

The unemployment rate of 3.7% remains low compared to recent history.⁹ Since 2000, if we exclude the 12 months starting March 2020 (COVID), the average unemployment rate has been 5.6%. US employers added 2.7 million jobs in 2023, exceeding jobs added annually pre-pandemic. Positive wage growth confirms a tight labor market, however, the number of job openings plus hires and quit rates are trending downwards indicating some softening.

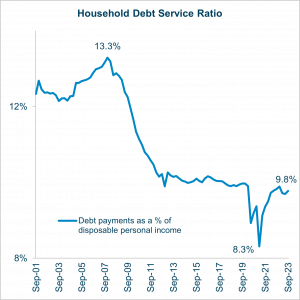

Consumer Spending & Debt

Sources: FRED and Federal Reserve Bank of Philadelphia

Consumer spending remains strong, though all but the wealthiest 20% of households have depleted most of their excess savings and are taking on more debt. The household debt service ratio increased from 8.3% in Q1 2021 to 9.8% in Q3 2023.¹⁰ This means that, on average, almost 10% of a household’s budget is consumed by debt service.

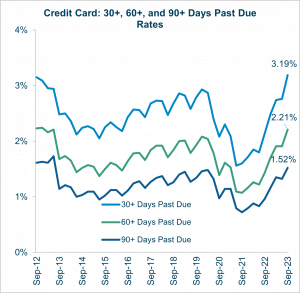

Sources: FRED and Federal Reserve Bank of Philadelphia

The high interest rates targeting inflation continue to put significant strains on poor Americans who are hardest hit by inflation. Similarly, delinquency and defaults rates are rising across all consumer loans. After reaching historical lows in Q2 2021, credit card delinquency rates have been steadily increasing and have surpassed pre-pandemic levels.¹¹

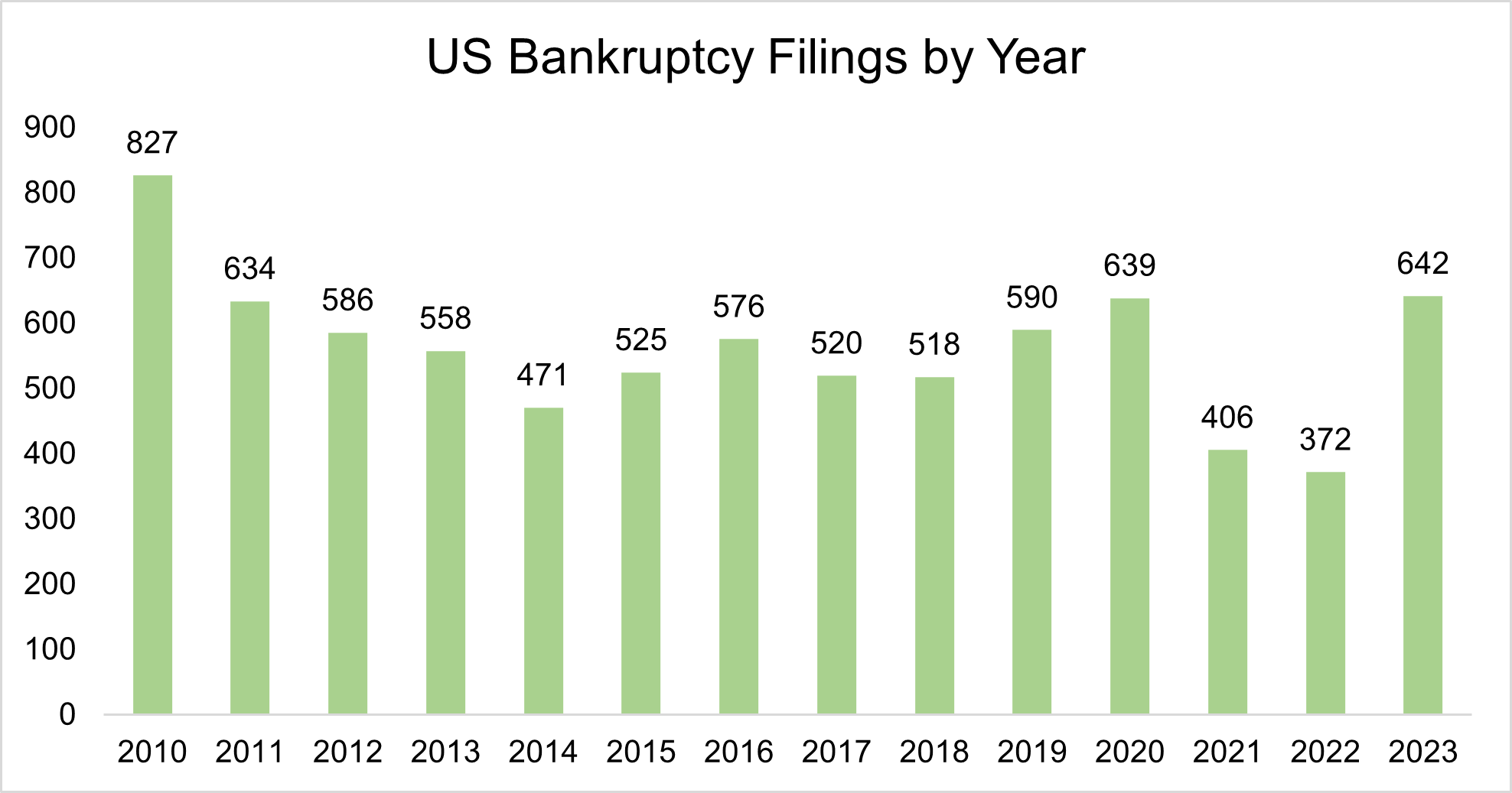

It is not only the consumer delinquencies and defaults that are rising. Corporate bankruptcy filings also rose in 2023 as a result of higher cost of funding driven by higher interest rates and higher expenses. According to S&P, 642 companies filed for bankruptcy in 2023, significantly higher than the previous two years and slightly higher than 2020.¹² Consumer discretionary, healthcare, and industrial sectors accounted for 243 of the total bankruptcy filings.¹³

Source: SPGlobal.com

Market Activity

In the second half of Q4, the markets matched the optimistic economic forecasts for a soft landing. Markets soared at year-end in anticipation of aggressive rate cuts by the Fed in 2024. As a result, Treasury yields dropped meaningfully across the curve resulting in a broad-market rally into year-end.

US equities posted double-digit returns and fixed income indices generated positive returns. US domestic equities outperformed international developed and emerging markets due to increased optimism of the US economy and performance of US companies. High yield was the best performing fixed income segment, but the tight spreads to Treasury yields appear ambivalent to the commonly associated risk of default in lower quality debt.

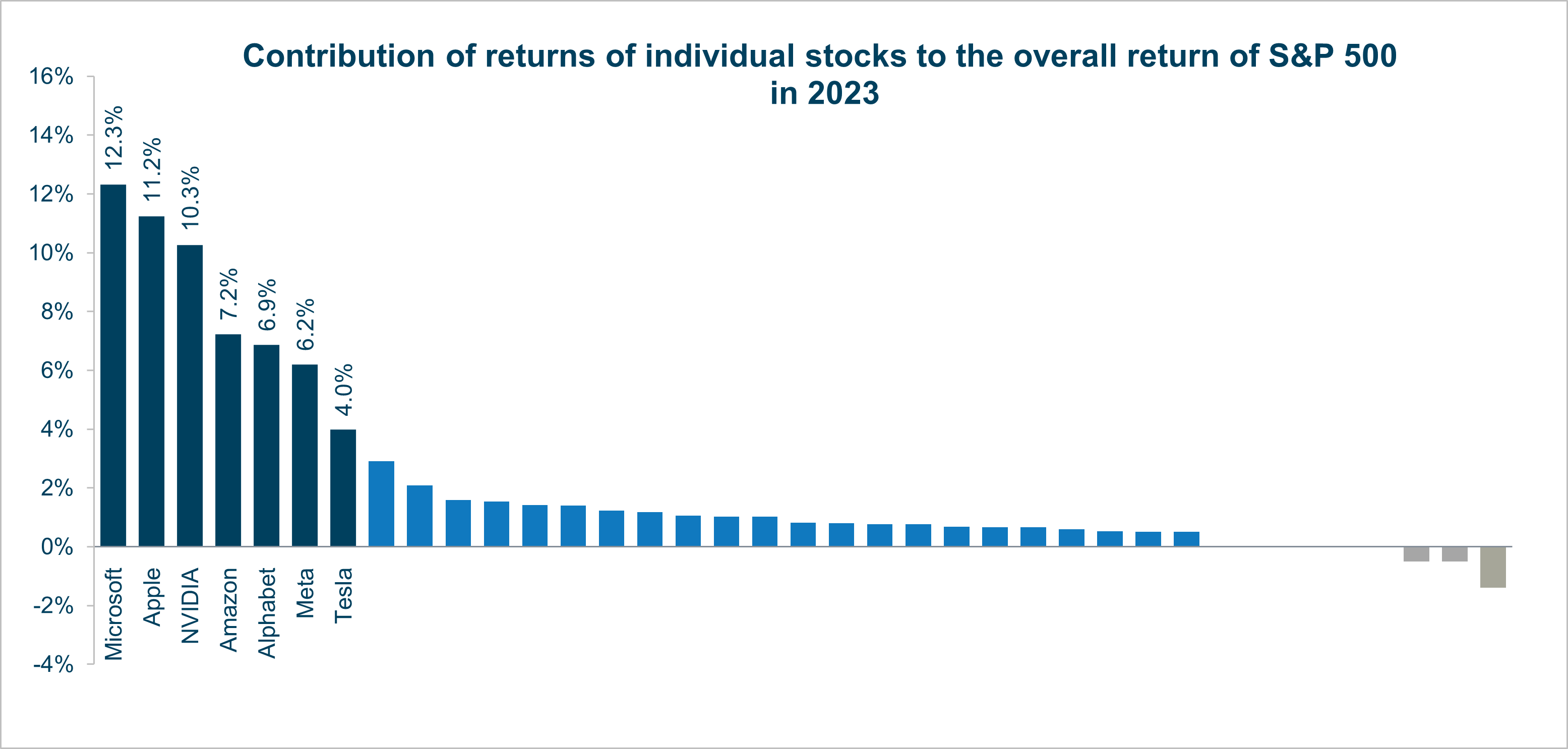

Magnificent Seven

The seven US large-cap companies nicknamed the “Magnificent Seven” – Microsoft, Apple, Nvidia, Meta, Amazon, Tesla, and Alphabet – were responsible for more than half of the stock market gains in 2023.

Source: Morningstar

The market rally in late Q4 spread across a higher number of stocks, thereby reducing the contribution of the Magnificent Seven to total returns for the year. Despite that, the Magnificent Seven represented approximately 26% of the S&P 500 Index weight and accounted for 58% of the S&P 500 Index returns for the year.¹⁴

The concentration is not just limited to the US market index. As of the end of 2023, Apple (19.5%), Microsoft (17.2%), and Nvidia (7.9%) together accounted for approximately 45% of the MSCI ACWI Information Technology index, Alphabet (Class A 16.8% & Class C 14.9%) and Meta (15.9%) account for approximately 48% of the MSCI ACWI Communication Services, and Amazon (18.9%) and Tesla (9.5%) account for about 29% of MSCI ACWI Consumer Discretionary index.

The concentration and contribution to returns of the “Magnificent Seven” are reflected in sector performance for the year. All sectors of the S&P 500 except Energy posted positive returns in Q4. Cyclical sectors outperformed defensive sectors. A recession or economic slowdown would likely weigh more heavily on cyclical sectors than on defensive ones. The Artificial Intelligence exuberance that drove the Magnificent Seven stocks higher in the first half of 2023 helped Technology, Communication Services and Consumer Discretionary sectors generate returns in excess of 40% for the full year 2023.

The concentration of the top 10 stocks in the S&P 500 and Magnificent Seven stocks within their respective three sectors remain at historic highs and resulted in benchmark risk, style biases and exposure to potential turn in investor sentiment towards these stocks.

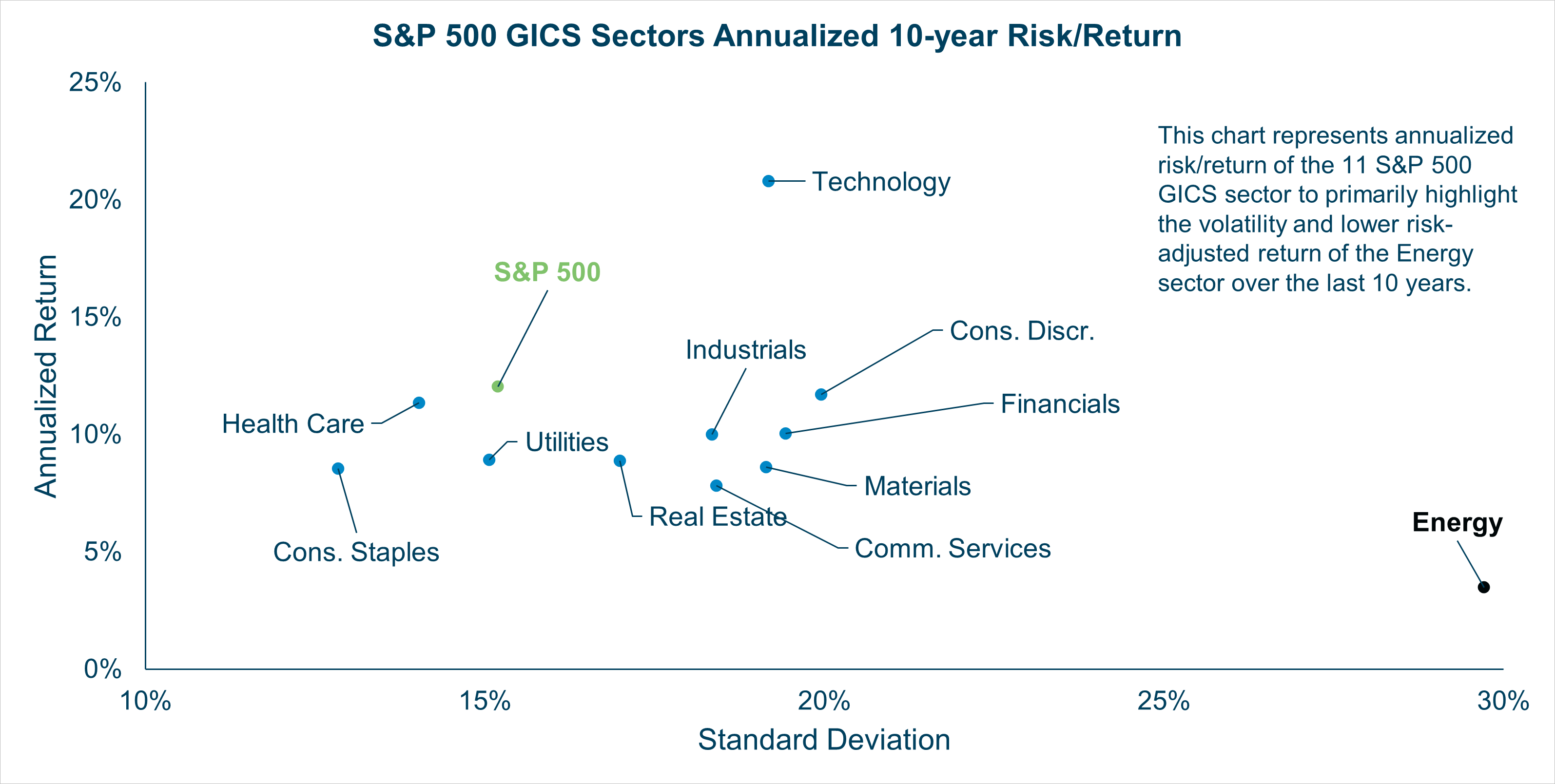

Focus on the Energy Sector

Despite the headline-grabbing 36.2% 3-year annualized returns, the Energy sector had negative returns in Q4 and 2023 and has trailed the other sectors on a risk-adjusted basis over 10 years.

Source: Morningstar

While the ongoing Russia-Ukraine and Israel-Hamas wars and reductions in oil and gas supply from Saudi Arabia and Russia provided short-term tailwinds to the traditional energy sector, we believe significant long-term headwinds include reduced demand and declining costs of renewable energy, transmission, and storage solutions.

Future Considerations

The Fed announced that it would maintain its policy rate in the range of 5.25% to 5.5% on January 31st for the fourth straight meeting. Chairman Powell acknowledged that further rate hikes are not likely and downplayed the likelihood of a rate cut in March but suggested that the Fed might cut rates sometime in 2024.¹⁵

While inflation has come down meaningfully, it remains higher than the Fed’s target of 2% and the Fed wants to see more evidence of sustained lower inflation before cutting rates amidst strong labor market and monthly inflation fluctuations.

The S&P 500, Nasdaq composite and the Dow lost 1.6%, 2.2% and 0.8%, on January 31st as the markets expected a rate cut in March.¹⁶ A decision by the Fed to not cut rates in future meetings may result in markets reacting negatively in the future, as the markets continue to expect rate cuts in 2024.

With the S&P 500 hitting a new high in January, it is timely to consider cash needs for the year and beyond. Please contact your Veris Advisor to consider your impact and spending goals for 2024.

Authors

Jane Swan is a Partner & Senior Advisor at Veris Wealth Partners and holds the Chartered Financial Analyst (CFA®) designation.

Roraj Pradhananga is a Partner & Managing Director of Investments at Veris Wealth Partners and a Certified Investment Management Analyst (CIMA®) and Certified Public Accountant (CPA).

Sources

2 U.S. Bureau of Economic Analysis, FRED, and U.S. Bureau of Labor Statistics

3 https://www.pmi.spglobal.com/Public/Home/PressRelease/9ee83c817447452686723bf10c149471

5 FRED and Federal Reserve Bank of Philadelphia

6 https://www.atlantafed.org/cqer/research/gdpnow

7 Bureau of Labor Statistics

8 Apartment List Rent Growth Rates

9 U.S. Bureau of Economic Analysis, FRED, and U.S. Bureau of Labor Statistics

10 FRED and Federal Reserve Bank of Philadelphia

14 Morningstar

15 https://www.cnbc.com/2024/01/31/fed-chief-jerome-powell-says-a-march-rate-cut-is-not-likely.html

16 https://apnews.com/article/wall-street-stocks-dow-nasdaq-6b769f978159d3a9fd07a07c8e73646a

Disclaimer

The information contained herein is provided for informational purposes only and should not be construed as the provision of personalized investment advice, or an offer to sell or the solicitation of any offer to buy any securities. Rather, the contents including, without limitation, any forecasts and projections, simply reflect the opinions and views of the authors.

All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change without notice. There is no guarantee that the views and opinions expressed herein will come to pass. Additionally, this document contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information derived from such third-party sources and take no responsibility, therefore. Information related to the performance of certain benchmark indices is provided for illustrative purposes only as investors cannot invest directly in an index. Past performance is not indicative of or a guarantee of future results. Investing involves risk, including the potential loss of all amounts invested.