Gender Lens Investing: Growing Interest, Increasing Options

Editor’s Note: This blog is a complement to a new analysis of gender lens investing (GLI) strategies by Veris Wealth Partners and Women Effect. Gender lens investments direct capital to companies and organizations that support the status and well being of women and girls. To access this information, please visit Women Effect. To read Veris’ GLI analyses from 2013 and 2015, please go to our Research page.

By Luisamaria Ruiz Carlile, CFP®, Senior Wealth Manager, and Alison Pyott, Partner & Senior Wealth Manager

In a few short years, Gender Lens Investing has moved from promising concept to potentially one of the next big things in impact and sustainable investing.

That’s one of the clear takeaways from a new, joint analysis on Gender Lens Investing by Veris and Women Effect published this week.

Consider the following:

- Assets Under Management (AUM) disclosed by GLI strategies investing in publically traded securities grew from $100 million as of Sept. 30, 2014 to $561 million as of June 30, 2016. That’s approaching a 500% increase.

- As of June 30 2016, there were 15 public market GLI equity and debt solutions, up from nine as of Sept. 30, 2014. Two of the new vehicles target non-U.S investors, including Canadian and those in select European and Asian countries.

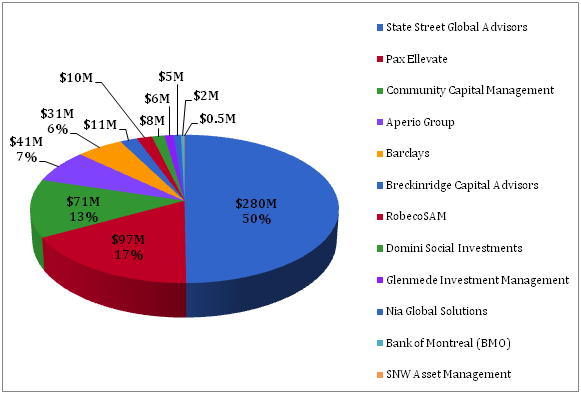

- More than half of the growth in AUM has been in the Gender Diversity Index ETF (SHE) from State Street Global Advisors. The ETF was launched in March 2016 and was seeded with an initial $250 million from Calsters (California State Teachers Retirement System).

The growth is the result of an accelerating desire by individual and institutional investors to place capital in investments that directly benefit women and girls.

Investment in Gender Lens Strategies Reporting AUM

($561 Million as of June 30, 2016)

“Expanding The Pie”

While the growth in GLI strategies has been heartening, equally important is the philosophical change they are engendering in the way we think about impact and sustainable investing.

For so long, many of us have viewed the world in “either/or” terms. Do we invest for societal and environmental benefits or purely financial returns? Do we opt for economic growth or a sustainable future? Ingrained (and often subconscious) biases may lead us to believe that for minorities and women to advance, others must lose. Or, that if we choose inclusive companies, we are settling for less than stellar investment performance. Our reality is seemingly zero-sum. I win, you lose.

This represents a scarcity mentality, as if life’s opportunities were a static pie and sharing it with more people means less for everyone.

However, people, communities and the environment are not pies! We all exist in a dynamic ecosystem that constantly responds to new inputs. GLI is a way to move beyond “either/or” thinking to “both/and” investing. More money invested in women and girls means more opportunities for society as a whole, men and boys included.

The good news is that GLI is taking off. More investing solutions will emerge as momentum grows for investing for gender parity. At the same time, a more holistic view of GLI’s benefits will bring more investors into the space, and that will benefit every segment of society.