What Will 2019 Bring For Investors

By Jane Swan, Partner and Senior Wealth Manager

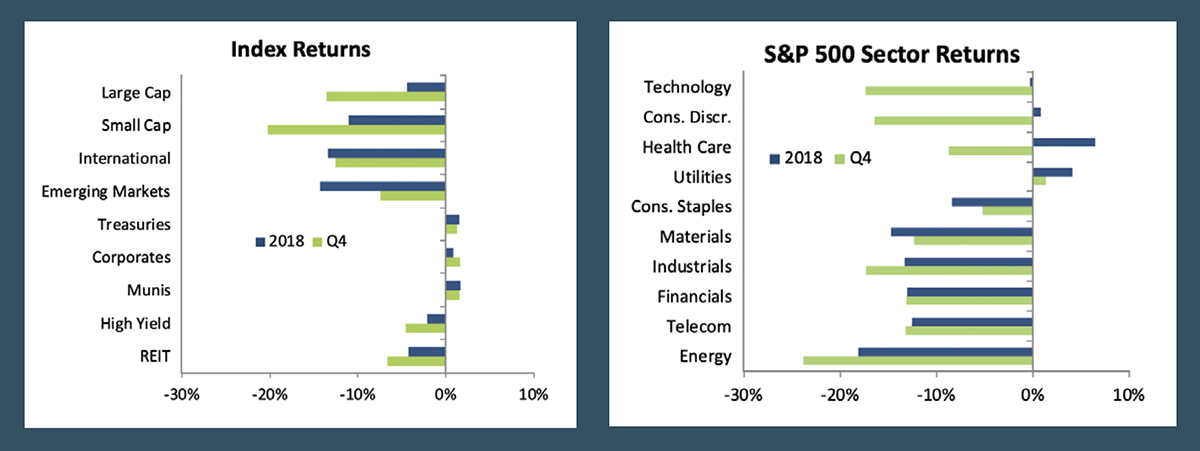

Stock markets finished 2018 with the worst quarter in more than seven years and the first year of negative returns in 10 years. All major global risk asset classes had negative returns. This includes stocks, REITs, and high yield bonds. Fixed income returns were positive, but very low with the multiple rate hikes in the year. Sectors of the S&P 500 were overwhelmingly negative with only small positive returns from Health Care, Utilities and Consumer Discretionary. Despite strong returns in the first half of the year, Energy was again the worst performing sector of both the quarter and the year.

Against this tenuous investment picture, we enter the season of annual investment forecasts. This ritual continues, despite limitations to the accuracy of these forecasts. While market predictions can be relatively reliable during periods of relative stability, their limited reliability in advance of economic inflection points can lead to failure during times when forecasts are actually most important. Investment and economic forecasting rely on a number of data points that are interpreted to develop scenarios of possible futures.

Market analysts and investors review data, assess the speed and severity of changes in trends, evaluate the moving parts in concert, and put them in context of the economic cycle and known and predictable global events. Balancing the many inputs is a mix of art and science, as the collection of inputs and their placement in history is always unique. Current readings of indicators may be similar to points in a previous cycle, but are never an exact repeat of any prior events. We try to assess what has happened in the past when some things were similar, and how the subtle differences may lead to different outcomes.

Recent headlines have included, “Why The S&P 500 Will Fall Another 20% In 2019” from Seeking Alpha, “S&P 500 will climb 15% in 2019 – here’s what to buy now” from MarketWatch, and from Bloomberg, “Save the Date: June 10 Is When Charts Say the Stock Turmoil Will End.” The absurdity of specificity in these forecasts highlights a dilemma for investors. And while we can watch economic indicators for signals of vulnerability, there always exists an additional supply of uncertainties. Shifts in consumer sentiment, changes to the yield curve, and other indicators can give us signals of market strengths or weaknesses. Natural disasters and human interventions are less predictable, but can have a significant impact.

In our current situation, we have troves of data to evaluate numerous trends, while finding bigger questions seemingly impossible to answer. We have low unemployment, signaling a strong workforce. If the market downturn of the fourth quarter quickly recovers, we will still be in the longest market expansion in history. The yield curve is nearly flat, suggesting concern about future growth. Corporate earnings are expected to grow, but at a slower rate than last year. And yet all this data still paints an opaque picture of future markets.

Crosscurrents In the Markets

Weighing on the market is a growing list of uncertainties that constrain the ability of businesses to plan. Uncertainty around Brexit makes it difficult for businesses in Europe to plan for growth, evaluate the positioning of their workforce, and determine where their HQ should be located. It is the time of year when U.S. farmers are planning their 2019 crops, but they don’t know if tariffs will continue to reduce their markets. Further the government shutdown has limited data they use to finalize crop planting plans. The effects of tariffs and the partial government shutdown continue to trickle into ancillary businesses the longer they continue, airlines for instance. The resolutions of Brexit, tariffs with China, the government shutdown, and the eventual conclusion of the Mueller investigation may cause bursts of market volatility. However, greater certainty, and resolution, around these matters may lead to a market boost as businesses simply can plan better.

The current accumulation of uncertainties is unusual. In Barron’s annual Roundtable of Experts, most expect the pressures of these uncertainties to resolve in the first half of the year but believe they will constrain economic growth as we await the resolution. These experts expect GDP growth somewhere between 0.5 and 2.4 percent in the first half of the year and a return to growth higher than 3 percent in the second half of the year after these uncertainties are presumably sorted. We can at least partially attribute the market decline from last quarter of 2018 to these escalating dilemmas. So long as they mostly resolve in the first quarter and no major new matters are added, we very well could return to a strong position in the economy and the stock market. That said, a year ago, these current market stressors of a possible hard Brexit or re-vote on the referendum, a trade war, and government shutdown lasting over a month, were at best distant on the horizon. Markets were celebrating the success of tax reform that hoped to raise stocks while increasing wages and consumer spending. All with little concern over increases to deficits.

The Big Picture

As we look to the year ahead, we work to keep all of this in perspective. In addition, as impact investors we consider long term implications of all opportunities. We take note that while the federal government opens and shuts down, on many levels, cities and states march forward in combating climate change. They are innovating in green and sustainable cities and housing and technologies. We are seeing solutions-based leadership. There are nearly 50 new models of electric vehicles and batteries coming on the market. Total oil used for cars and trucks hit peak and is actually dropping in the U.S. Some states are making bold experiments in new ways to deliver community healthcare. And more of us are awakening to the crisis of inequality in our democracy. Spotlighted by 1 million federal workers on shutdown struggling to pay basic bills, while eight billionaires are highlighted this week having equal wealth to 50% of the people of our world.

Considering these matters, Veris’ determined focus on climate change factors, gender lens characteristics, community wealth building and social equality, sustainable agriculture and forestry, as well as mindfulness gives us practice at looking beyond the old-fashioned forecasts. Our broader approach positions us to work with our clients to better understand risks and opportunities beyond those reflected in the standard list of economic indicators.

1 Seeking Alpha, January 7, 2019 “Why The S&P 500 Will Fall Another 20% in 2019” by https://seekingalpha.com/article/4231851-s-and-p-500-will-fall-another-20-percent-2019

2 MarketWatch, January 7, 2019, “Opinion: S&P 500 will climb 15% in 2019 – here’s what to buy now” by Michael Brush https://www.marketwatch.com/story/sp-500-will-climb-15-in-2019-heres-what-to-buy-now-2019-01-07

3 Bloomberg Markets, January 23, 2019 “Save the Date: June 10 Is When Charts Say the Stock Turmoil Will End” by Elena Popina https://www.bloomberg.com/news/articles/2019-01-23/save-the-date-june-10-is-when-charts-say-stock-turmoil-will-end