2023 End of Year Letter From Veris CIO Michael Lent

By Michael Lent, Co-founder and CIO of Veris Wealth Partners

This letter was originally published as part of Veris’ 2023 Impact Report.

I write this at a time of great turbulence in the world. We are seeing acts of violence and warfare, extreme partisanship and political turmoil, and a barrage of attacks on ESG investing and DEI practices.

It can sometimes be hard to feel hopeful in this period, but I still believe that progress is being made and that impact investors are making meaningful contributions towards solving social and environmental challenges.

Despite the turbulence, the US economy has been doing fairly well,¹ workers have been gaining at the bargaining table,² and the energy transition is moving forward³ (albeit at a slower pace than we would like to see).

Silver Linings

In my view, the attacks on ESG and DEI present an opportunity for us to determine who in the investment field is authentically committed to these issues and who is not. For example, some mutual funds and ETFs have stopped marketing themselves as ESG or Sustainable because they were not truly committed to an authentic process and instead were greenwashing.⁴

The SEC recently adopted the Names Rule which requires funds that use ESG in the name invest at least 80% of the value of its assets in alignment with ESG factors.⁵ It appears that some asset managers and investors do not want to stand up to the scrutiny of the Republican AGs and House committees and have stopped using ESG or DEI in fund names even if they continue to offer investment options in this area.

However, those funds and managers that are committed to ESG and DEI are staying the course and continuing to innovate, deepen their analysis, and move our field forward.⁶

Challenges We Are Facing on the Route to a Decarbonized Economy

It is important to recognize that it has been a difficult market environment for ESG and Impact Investors as well. The traditional energy sector (oil and gas), which is one of the largest contributors to climate change, has been one of the best performing areas of the public equity markets over the past three years due to the Russian invasion of Ukraine, OPEC+ supply constraints coming from Saudi Arabia and Russia, and the emerging Middle East Conflict.⁷

Renewable energy stocks have underperformed during the same time due to their high capital requirements, higher borrowing costs, and increased cost of inputs.⁸ ⁹

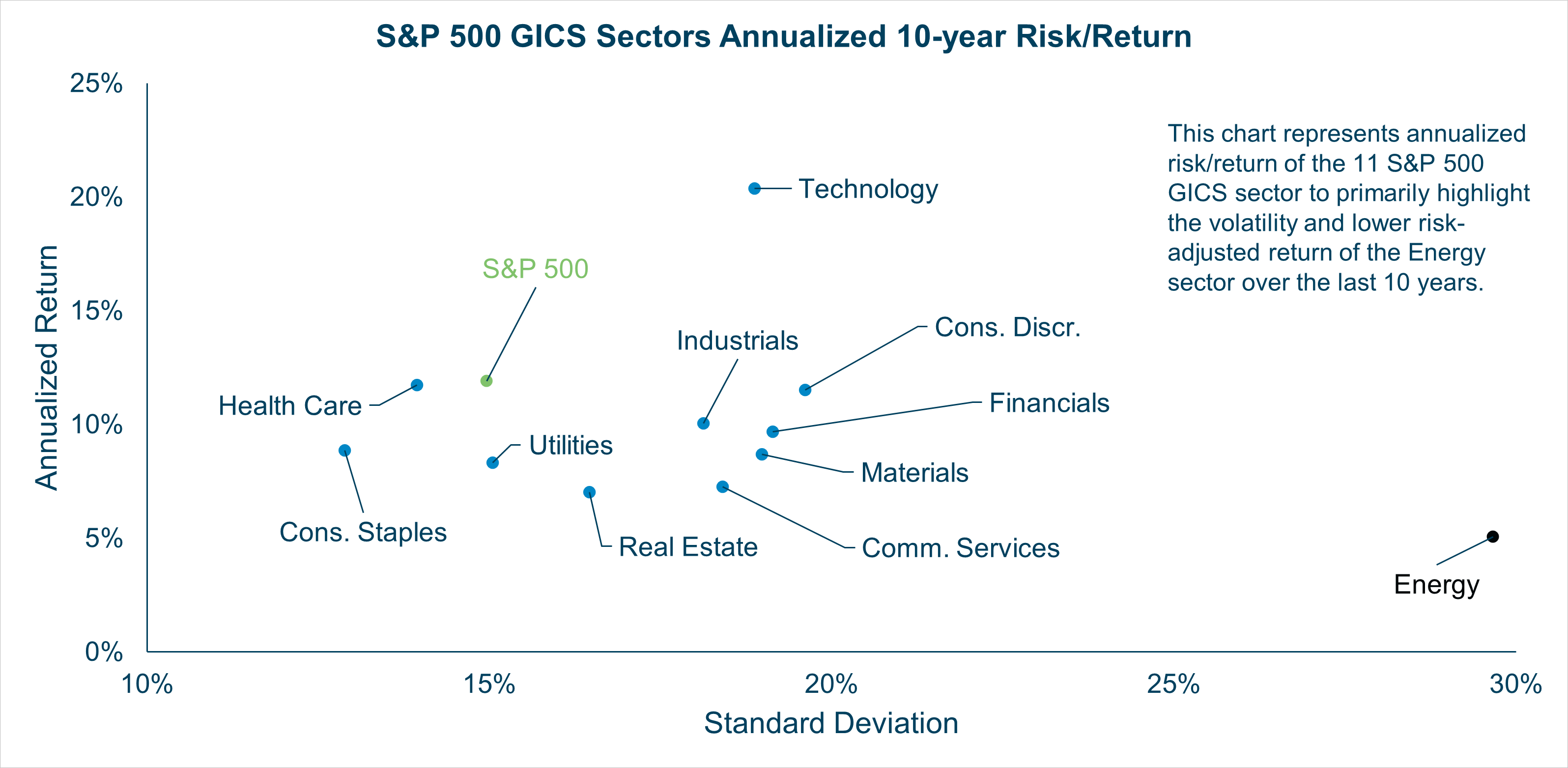

This has had an impact on portfolios that are fossil fuel free and low carbon. Some environmental thematic equity managers and funds have had some short-term underperformance. However, we see this as a short-term phenomenon. Over the past ten years traditional energy stocks have been the worst performing sector of the market.

The US Inflation Reduction Act, the Chinese commitment to significant investment in solar power and Electric Vehicles, the need for Europe to become less dependent on natural gas and the innovations in energy efficiency and other low carbon options will likely provide a tailwind over the medium term.

We think the current challenge is bringing together the desire to decarbonize the economy with a just transition that addresses frontline community needs and the need for POC and labor to participate in the economy of the future. Our report highlights our Just Transition Investment Framework and two investment examples. We are committed to identifying more options in the next several years as we see this as one of the most important contributions impact investors can make.

Progress Towards Our Firm’s Equity, Diversity, and Inclusion Goals

Veris has made a commitment to continue to bring EDI managers on our platform and work with our current managers to encourage progress in this area. See our firm’s report on Investing in Diversity, Equity, Inclusion, and Belonging for more information about our approach.

Despite the attacks on DEI, we have been able to identify new opportunities for investing with DEI managers: both diverse teams and those using a DEI investing lens.

We have brought to our platform several excellent EDI managers, some of whom are first-time fund managers. Investing in first-time EDI managers is critical to ensure that the field becomes more diverse in the future. As we have outlined in this report our engagements with our approved managers have resulted in better EDI-specific data collection and we are seeing improvement in the diversity of metrics and disclosures. While these improvements are important, we are committed to making further progress to meet our goals.

Our Work Continues

Since the very beginning of our firm’s history, Veris has had a vision to build a more just, equitable, and sustainable world through our investments and our practices. The challenges the world is facing require bold and innovative approaches. We are not daunted by the most recent challenges and see that they create new opportunities.

I thank our Managing Director of Investments, Roraj Pradhananga and his Investments Team for the excellent work they are doing in advancing our impact investing research and continuing to innovate to achieve our vision.

Michael Lent

Chief Investment Officer and Founding Partner

References

1 https://www.bea.gov/news/2023/gross-domestic-product-third-quarter-2023-advance-estimate

2 https://www.bloomberg.com/news/articles/2023-10-28/uaw-aims-to-announce-stellantis-deal-saturday-as-talks-finish-up

3 https://www.bloomberg.com/news/articles/2023-01-26/global-clean-energy-investments-match-fossil-fuel-for-first-time

4 https://www.morningstar.com/sustainable-investing/sec-targets-greenwashing-with-dws-investments-settlement-names-rule

5 https://www.morningstar.com/sustainable-investing/sec-targets-greenwashing-with-dws-investments-settlement-names-rule

6 www.institutionalinvestor.com/article/2cdc8zv066plxdq1p83cw/culture/how-the-fearless-fund-lawsuit-is-provoking-outrage-new-dei-strategies-and-renewed-commitment

7 https://www.bloomberg.com/news/articles/2023-10-20/energy-stocks-keep-rising-after-middle-east-tensions-widen

8 https://www.ctvc.co/spooky-season-for-clean-energy-stocks-171/

9 https://www.bloomberg.com/news/articles/2023-10-20/a-5-bond-yield-means-280-billion-green-stocks-rout-will-worsen

This content is intended for informational purposes only, provides only a summary of topics discussed, does not constitute personalized investment advice or recommendations, and solely reflects the opinions of Veris Wealth Partners (“Veris”), which are subject to change without notice. The information contained in this document contains certain forward-looking statements, often characterized by words such as “believes,” “anticipates,” “plans,” “expects,” “projects,” and other similar words, that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements.

Certain information contained herein is derived from third party sources. While Veris believes such information to be accurate, we have not independently verified the accuracy or completeness of such information.