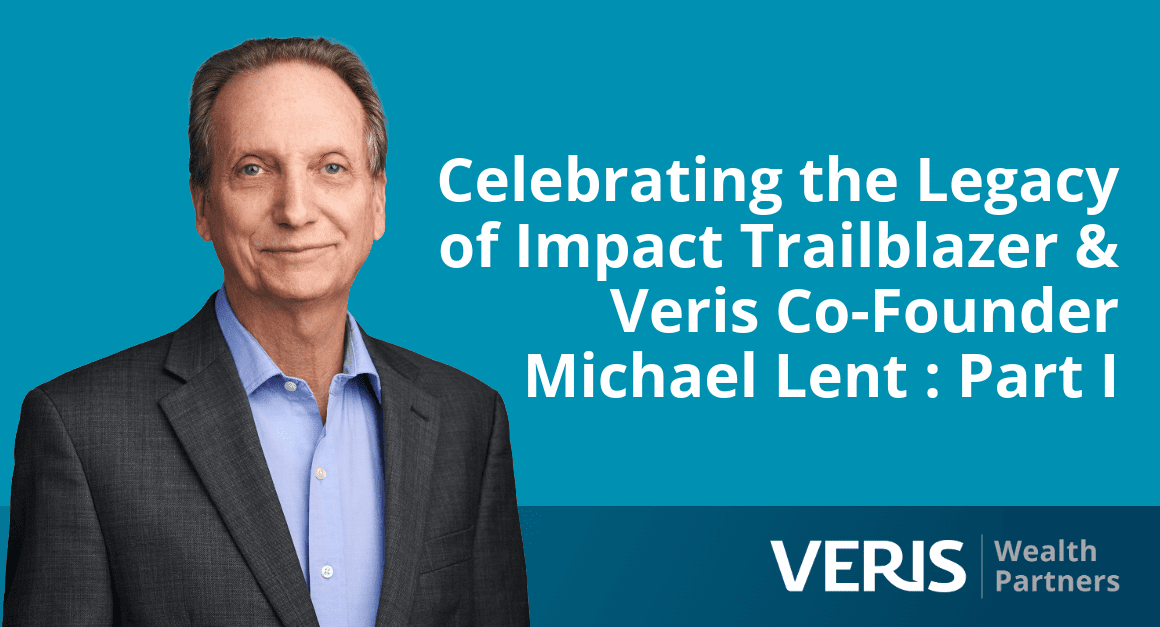

Celebrating the Legacy of Impact Trailblazer and Veris Co-Founder Michael Lent: Part I

Veris Co-founder Michael Lent is a long time leader in the field of impact investing whose work helped shape the landscape of sustainable finance. To mark his retirement from his role as Senior Advisor at the end of 2025, we are proud to present a special two-part interview series celebrating Michael’s profound impact on our firm and industry.

A visionary who helped build the New York office of the nation’s first socially responsible broker-dealer before helping launch Veris in 2007, Michael spent over three decades in pursuit of both professional financial excellence and deep social and environmental impact. In this retrospective, the firm’s founding Chief Investment Officer and former US SIF Board Chair reflects on the history of the field, the development of Veris’ culture of belonging, and his enduring vision for the future of values-aligned investing.

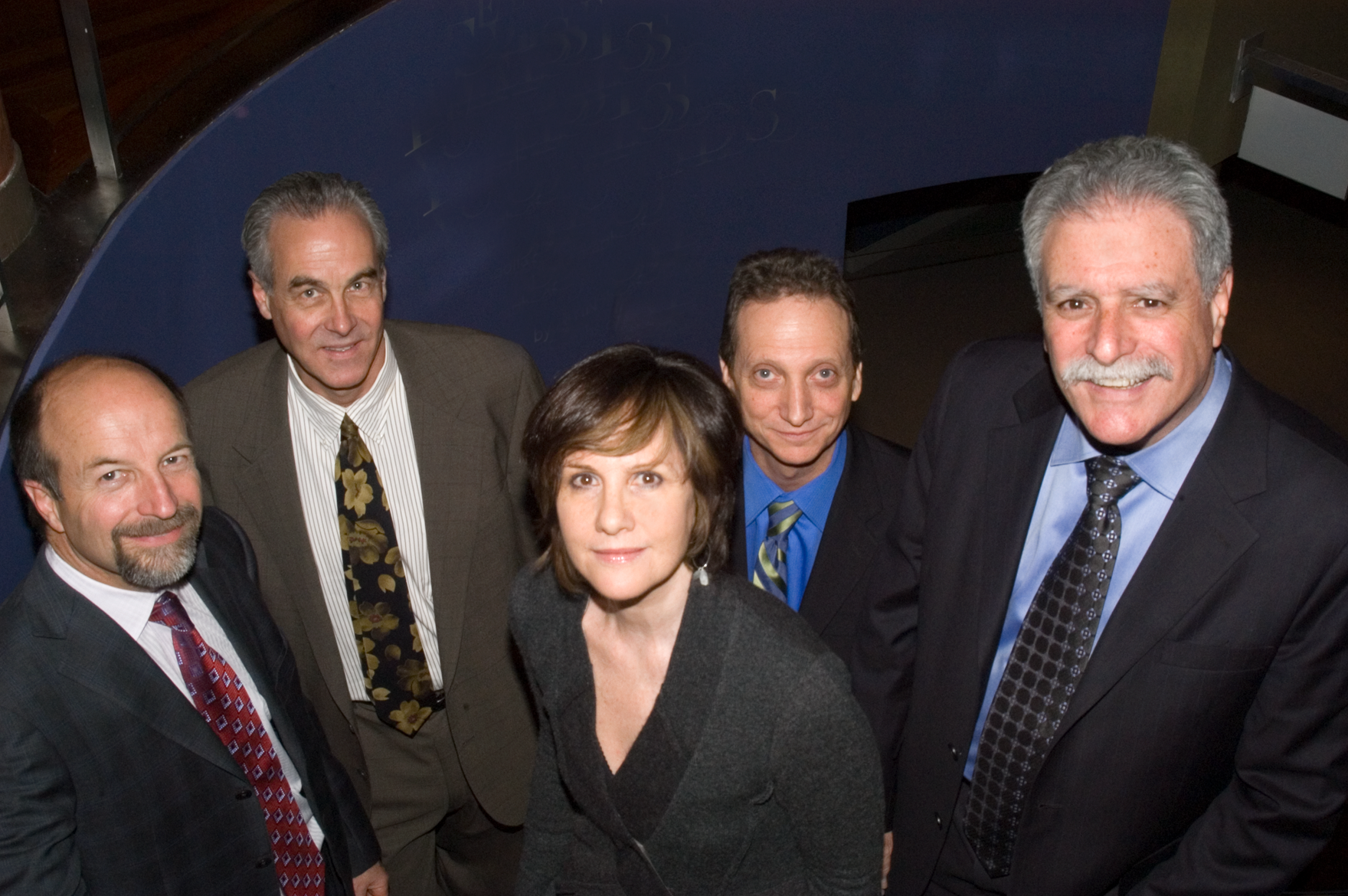

Veris Co Founders David Hills, Anders Ferguson, Patricia Farrar-Rivas, Michael Lent, and Steve Fahrer

You and your Veris Co-founders were early actors in the field of impact investing. Can you tell us about the founding of Veris Wealth Partners in context of the history of the industry?

Michael Lent: Veris was formed at a very interesting time in the evolution of impact investing, but the origins of the field go back at least to when Quakers refused to invest in businesses that profited off of slavery in the 1800s.¹ In more recent history, two Methodist ministers helped start PAX World Fund in 1971 as a response to the Vietnam War, the Civil Rights Movement, and the Women’s Movement. That was the first publicly available socially responsible mutual fund in the United States. You can also trace the origin of corporate responsibility and shareholder engagement as a part of investing with values to 1971 with the founding of the Interfaith Center to Corporate Responsibility (ICCR). The faith-based organizations that were part of the ICCR were some of the first institutional investors to directly engage companies around corporate responsibility.²

The social responsibility campaigns urging companies toward sustainability in the 1980s and 1990s were an important antecedent to the field of impact investing. Several important organizations were launched during that time including The Social Venture Network in 1987³ and the Businesses for Social Responsibility (BSR) in 1992.⁴ It was also in the 1990s when trailblazers like Amy Domini, Joan Bavaria, and David Hills helped build the foundations of what would become the impact investing industry.

A critical development was the founding of Kinder, Lydenberg, and Domini (KLD) in 1990,⁵ which was the first research firm to apply environmental, social, and governance considerations when analyzing publicly traded companies. KLD provided crucial research in the early 1990s when a few portfolio managers needed to know of a company’s environmental, social issues, and governance practices. Another important step was the formation of the first Socially Responsible Investment (SRI) index fund called the Domini 400 Social Index, which launched in May of 1990.⁶

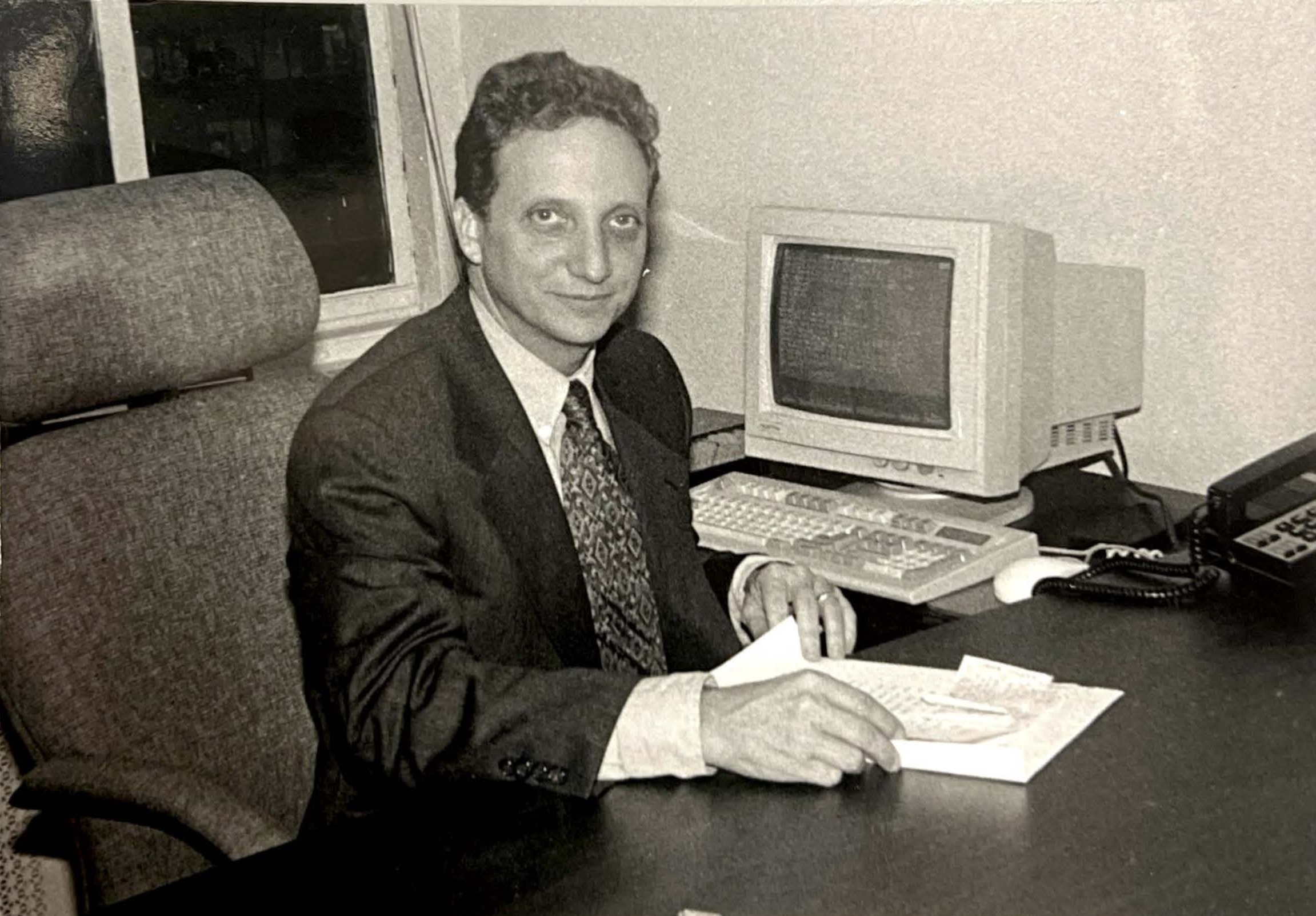

It was in the context of this early field building that I began working at Progressive Asset Management, a brokerage firm focused on socially responsible investing. My own career path to impact investing first began in Central America, where I was hired to raise capital for a high impact social/environmental company called Earth Trade. Earth Trade supported cooperative farmers in Central America who were growing sustainably produced agricultural products that were marketed across Latin America and globally.

Michael Lent in the New York office of Progressive Asset Management.

That work eventually led me to Progressive Asset Management, which was the first national broker dealer with a focus on what we then called socially responsible investing. That is where I first began working with Patricia Farrar-Rivas and Steve Fahrer. Patricia, Steve, and I helped build the New York office of Progressive Asset Management and then in 2006 we began discussing the idea of forming our own company.

Steve, Patricia, and I began meeting with David Hills and Anders Ferguson to discuss and form a plan and to see if we could work well together as founding partners. We spent a lot of time talking about who we were, what our backgrounds were, what we cared about. From the very beginning, we envisioned an independent, employee-owned firm dedicated to working with high net worth individuals, foundations, and endowments. Independence has always been important to us because it allows flexibility while eliminating conflicts of interest.

We started out guided by a shared aim to form a culture of excellence in serving clients both in terms of traditional financial planning services and also impact investing across asset classes in public and private markets. As a next step, we engaged Envestnet to serve as our platform and hired our first staff. Alison Pyott, Lori Choi, Nicole Davis, and Leah Beattie were early Veris team members who were key to our early success. David, Steve, Patricia, and I had existing clients that were interested in impact investing that wanted to continue working with us.

Our clients had experience and expertise in different areas of impact and themes – sustainable and regenerative agriculture, for example, and we wanted to learn from them. It was always critically important to us that our clients were part of our learning process.

As a firm, we aimed to create a community and a field that would include clients, managers, various research people, and nonprofits that could help build up the field. Even in the earliest days, we discussed the importance of providing thought leadership and participating in networks with other field builders. One of our key principles was that we were going to actively participate in building the field and developing the industry of impact investing. Patricia and I worked very closely with Confluence Philanthropy, a network of foundations practicing mission related investing (MRI), when they started out in 2009 and I served as Chair of the Board of US SIF in 2011.

You were Board Chair of US SIF during a pivotal time in the organization’s history. What are some of the key field building initiatives that you were involved in then that you are most proud of today?

Michael Lent: When I was Board Chair of US SIF, our focus was on building the organization on an operational level and growing by bringing in new members. We aimed to broaden out the organization’s membership to include a number of larger financial institutions.

We launched several key policy initiatives that I worked on, engaging with the SEC and Congress during that period. My term was during the great financial crisis, and we worked a lot on policy initiatives when Obama came into office – particularly the Dodd-Frank Bill. The banks that caused the crisis were enabled by policies that put people at risk and destabilized the economy, so we sought to promote regulations of the banking sector in direct response.

In terms of field-building, we focused on education and developed the first advisor training program with an aim of having some form of accreditation. It was also during that time that we professionalized US SIF’s Trends Report, which became critical in terms of documenting how the industry was growing. We aimed to become the central voice of the industry. Our goal was to bring together broker dealers, individual advisors, research houses, foundations and endowments, et cetera.

What is something that you always wished more people understood about impact investing?

Michael Lent: One of the things I’ve found that people often don’t understand about impact investing, is that we have a dual mandate from our clients – they want to see the best outcomes in terms of both financial performance and impact performance.

From the very beginning of my career, I wanted to bring the best traditional investment approach to my work as an impact investor. I wanted to have a full understanding of all aspects of constructing portfolios, monitoring performance, and understanding markets. I became a Certified Investment Management Analyst (CIMA) to support my work as an investment consultant serving institutions and families and my learning never stopped.

I believe that our firm’s ability to deliver financial professionalism and research expertise has been key to our success. I’m proud that Veris has built such a fantastic team of Advisors backed by an Investments team with an excellent and rigorous due diligence process.

In the next article, Michael shares important lessons he learned over the course of his career and offers his vision for the future. Read Part II: Celebrating the Legacy of Impact Trailblazer and Veris Co-Founder Michael Lent.

Disclaimer

The information contained herein is provided for informational purposes only, represents only a summary of topics discussed, should not be construed as the provision of personalized investment advice, or an offer to sell or the solicitation of any offer to buy any securities. Rather, the contents including, without limitation, any forecasts and projections, simply reflect the opinions and views of the authors.