Economic Perspective Q2 2017

by Steve Fahrer, Partner

An important milestone occurred in the second quarter. No, it wasn’t that the S&P500 and the Dow Jones Industrial Average made new highs during the quarter. Nor was it that the stock market went 12 months without a 5% correction. If you were thinking the milestone was the Federal Reserve raising the Federal Fund Rate to 1.25%, the highest it has been since 2008, you would unfortunately be wrong again.

No, the big milestone was that in March and April, U.S. monthly renewable energy production exceeded power provided by nuclear energy plants for the first time since July 1984 according to the U.S. Department of Energy. This is a big milestone.

The U.S. Energy Information Administration reported that spikes in hydropower, wind and solar, coupled with a dip in nuclear production led to the change during those two months. Hydropower also reached its highest production in six years due to record precipitation and snowpack in California. For the year, nuclear will likely out-produce renewable energy, but this promising trend seems to only be growing.

Next stop will be when renewable energy surpasses coal, despite the President’s hostility toward climate action. Pulling out of the Paris Accords cannot stop the rising use of renewable energy. The heartland of America is producing massive

amounts of wind-driven power and exporting electricity around the country, even though their Governors often do not

believe in global warming. Renewable energy makes good economic sense. It is unstoppable.

Speaking of coal, it has also come to light that the number of coal mining jobs lost in West Virginia and Appalachia is only a small fraction of the number of jobs created nationally by the Affordable Care Act. There is no telling the economic displacement if the Affordable Care Act is repealed. Fortunately Obamacare also provides healthcare benefits for coal workers suffering from long years working underground in the mines. The balance of 2017 will probably indicate whether

the U.S. keeps some delivery system for affordable healthcare or not.

As it turns out, healthcare represents 17% of U.S. Gross Domestic Product. Big cuts in Obamacare threaten millions

of Americans’ health and economic wellbeing. This is not to say that we don’t overspend on healthcare. A single-payer system may be more fiscally responsible, but repeal is not the answer without a better replacement. Severely cutting healthcare benefits will not lead to 3% growth in GDP.

2017 Q1 Asset Class Returns

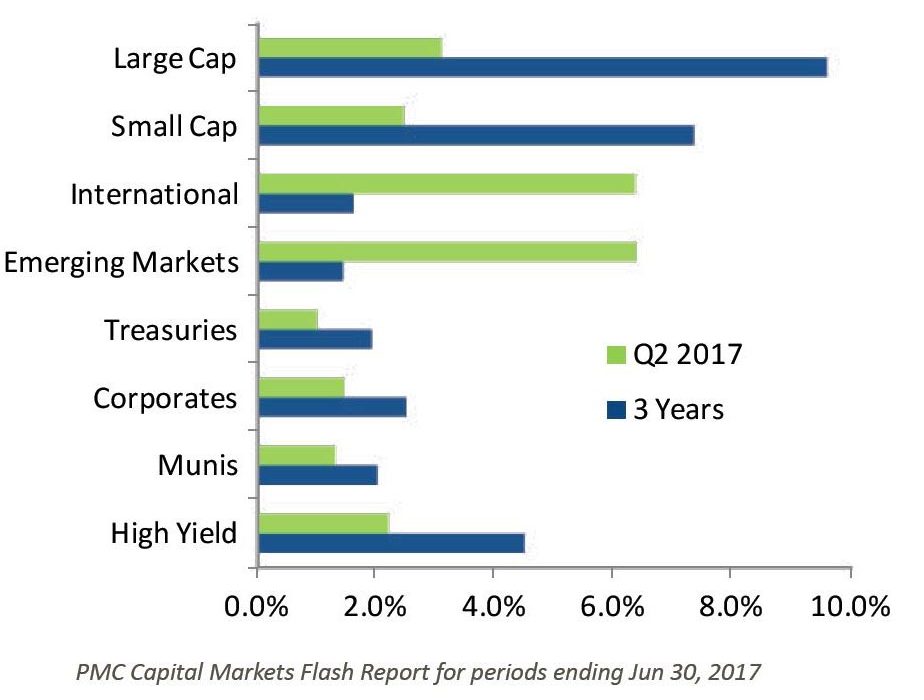

The second quarter was positive for the stock market despite the third increase in the last nine months to the Federal Reserve’s Overnight rate to 1.25%. Fears of even higher rates slowed the rise in the S&P500 to 3.09% in the second quarter from 6.07% in the previous quarter. Yet, as short-term interest rates rose, longer rates such as the 10- year Treasury bond, a bellwether, have not risen in tandem, indicating that the bond market thinks the economy is so-so. On the other hand, the stock market proclaims, “We are the only game in town!” For a change, the U.S. stock markets did not dominate. International stocks as measured by the MSCI EAFE returned 6.38% and the emerging markets in aggregate also outperformed the S&P500.

2017 Q1 Sector Returns

The economy remains in a 2% growth mode and the goal of 3% growth proclaimed by the President is out of the question for now. We continue to see a slow growth economy ahead, growing closer to a rate of 2% annually than 3%. If the promises of the Trump Agenda for lower personal and corporate taxes as well as tax breaks for U.S. companies holding dollars overseas don’t pan out, we may see some turbulence in the financial markets. A slow growing economy with inflation under 2% does not call for higher interest rates. Even though the economy looks to be approaching full employment, wage increases are tepid. It is doubtful the Fed will raise rates much higher unless the economy picks up steam. If interest rates rise slowly or not at all, the stock market should trudge higher. Enjoy your summer while you can.